Gardens Budget Splits the Difference with the Taxpayer

Posted by PBG Watch on September 9, 2015 · Leave a Comment

The FY2016 Budget for Palm Beach Gardens will be discussed at the first public hearing on September 10.

Property valuations are up significantly this year, and some jurisdictions are reaping large windfalls by leaving their millage flat. The county for example, will see a tax increase of over 9%, which will be their largest budget in history, growing by $61M in new taxes – bigger than the entire budget for PBG.

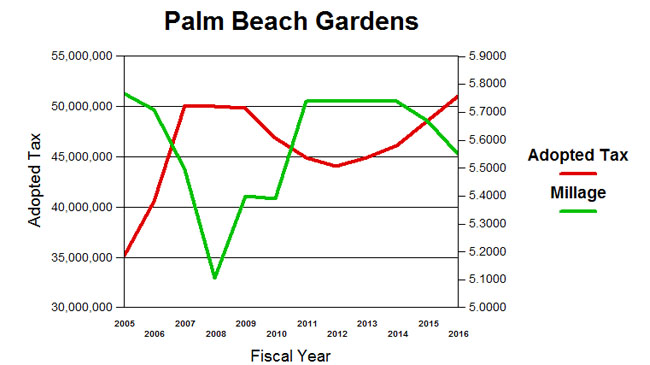

The Gardens Council is being more responsible than the county and proposes to return some of the valuation windfall to the taxpayer. It should be noted though, that this year’s proposed $51M in revenue is the largest budget to date, exceeding those of the boom years of 2007-2008.

As the included chart shows, when the valuation bubble burst in 2008, PBG increased the millage to maintain flat tax revenue around $50M, then relented in 2009 and let revenue decline below $45M as the economy remained stagnant. Now that there is an increase in valuation (over 6% this year) the proposed millage would be reduced to limit the rise in revenue to just under 5% (on top of 5.3% last year).

If the millage were left unchanged, it would have generated over $52M, so the “extra” $1M (2%) would be returned to the taxpayer.

Compared to the money grab that’s going on at the county, we should be grateful to our staff and Council for their restraint. If you go to the meeting on Thursday, thank them for that, and ask them to stick to the plan. It is still possible to raise the millage (up to 5.67), and some groups may come to lobby for more spending.