PBG 3.3% Tax Increase Actually Less than Inflation

September 4, 2021

The proposed 2021 PBG Budget raises about $2.3M in new taxes, up a modest 3.3% over last year. See the Proposed Budget here.

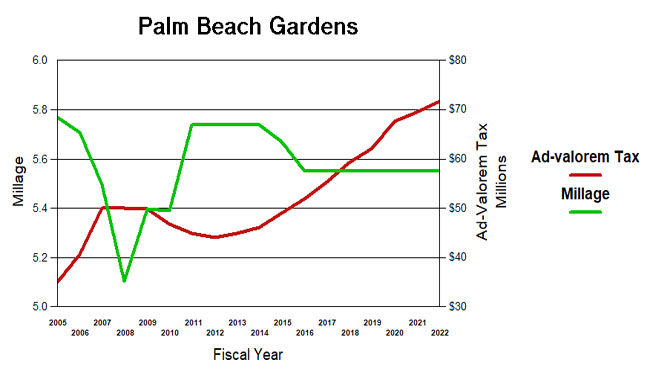

With the millage flat at 5.55 since reduced to that level in 2016, this is the seventh year that increases in property valuations and new construction have provided an equivalent increase in revenue without raising the tax rate. In 2015, ad-valorem revenue was $49M. This year’s $72M is a 46% increase over the six years of flat millage.

Unlike the six years previous, the 2022 budget needs to be thought of differently because excessive federal spending and money printing by the Federal Reserve has brought us a repeat of the inflationary environment of the ’70s. The Bureau of Labor Statistics tracks the “CONSUMER PRICE INDEX FOR ALL URBAN CONSUMERS (CPI-U)” monthly. In July of this year, that figure stands at 273 – up a whopping 5.4% over one year ago when it was 259. It has been climbing at a yearly rate in excess of 5% for the last 3 months, and was up 4.2% in April. In prior budget years, inflation was negligible compared to increases in the ad valorem tax. Let’s assume it continues for another 9 months and the July 2022 figure is 288. Adjusting the tax increase for inflation, the $72M becomes $68M in 2021 dollars – a $1.4M decrease (-2%) in Ad Valorem taxes.

Projecting out the PBG population estimates from the Bureau of Economic and Business Research (BEBR at UFL), the Gardens population will be just shy of 59K in 2022, up about 2%. The TABOR multiple (Taxpayer Bill of Rights – inflation times population growth) is therefore about 7.5%.

TABOR

In 1992, the state of Colorado amended their constitution to restrict the growth of taxation. Under the “Taxpayer Bill of Rights” (TABOR), state and local governments could not raise tax rates without voter approval and could not spend revenues collected under existing tax rates without voter approval if revenues grow faster than the rate of inflation and population growth. The results of this Colorado experiment are mixed, and TABOR has its pros and cons. (For background on TABOR, see: Taxpayer Bill of Rights ) Population growth and inflation though, would seem to be a way of assessing the appropriateness of the growth of a city budget, at least as an initial benchmark.

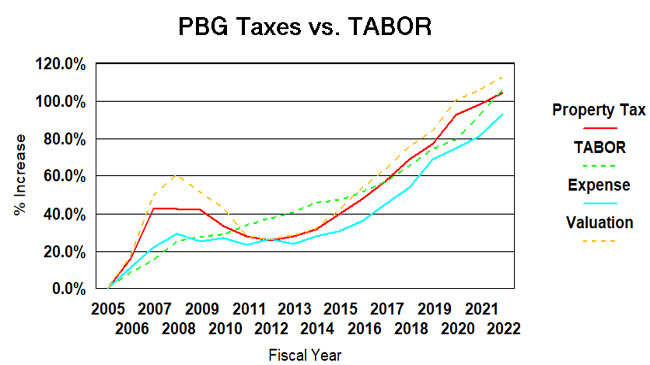

Since 2005, the population of Palm Beach Gardens will have grown by about 40% (BEBR estimate – see below) to its estimated 2022 level of 59K. Inflation, measured by the consumer price index, will be about 48%. Taken together, TABOR would suggest a growth in city spending and taxation of about 107%. (see graph below).

Over the same period (2005-2021), ad-valorem taxes grew 104% and total expenditures (budget less debt payment, capital and transfers) grew 93%. Spending closely follows the TABOR line, and ad-valorem taxes is not widely divergent (although exceeding TABOR since 2017) suggesting spending and taxation appropriate to a growing city.

It should be noted that ad-valorem taxes fund only a part of city expenditures, the rest made up from impact fees, fees for services, other taxes, intergovernmental grants, etc. and have varied from 66% of the total in 2005 to about 70% now. That is why taxes and expenses do not track each other on the chart.

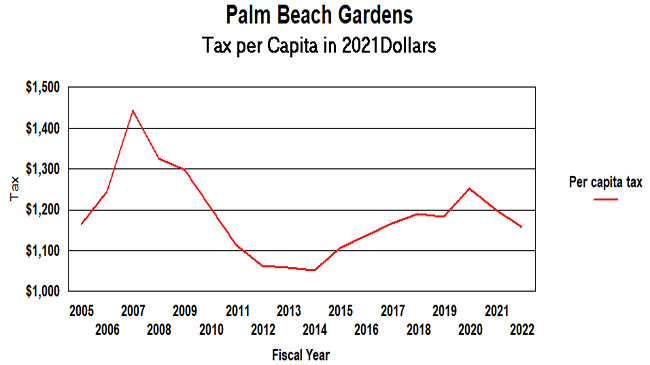

Another useful measurement is taxes per capita – Ad valorem taxes divided by population and then inflation adjusted. By this measure, in 2005 we paid $1,170 per person to our city and in 2022 it will be $1,154 (2021 dollars) – an actual decline. Tax per capita was as low as $1056 in 2014 after a millage reduction. It should be noted that as property owners, we pay taxes to other entities besides the city – county, schools, health care district, etc. In 2021 the Palm Beach Gardens portion of the amount on our TRIM statement is about 27% of the total.

The chart below shows an actual decline in per-capita taxation for two years in a row. However, there is reason to believe the BEBR population estimates have missed some of the city’s growth (see below). If the numbers were to be adjusted to match the growth in voter registrations since 2016 for example, the curve would be flatter since there are more people to pay the taxes.

So if you trust TABOR, or per-capita as measuring sticks, this modest growth in taxation for 2021 seems appropriate in our view. You be the judge.

A word about population estimates.

Estimates of the Gardens population vary. The numbers used in the preceding two charts are based on the University of Florida’s Bureau of Business and Economic Research (BEBR) data. By their measure, we have grown 34.6% to 2020 (the last number given) since 2005. The US Census has a different set of numbers and they claim 39% over the same period. BEBR says we had 56,709 residents in 2020. the Census said 58,410. Projecting to 2021 at the same rates would get approximately 59K and 60K respectively.

I have reason to believe that both of these estimates are too low. In 2017, the city annexed Osprey Isles and Carleton Oaks (about 650 residents) and in 2018 Bay Hill and Rustic Lakes (aobut 1340 residents). It is not clear that either BEBR or the census adjusts for annexations between census decennials. Also, certain areas of the city are growing rapidly, such as Alton and soon Avenir.