Gardens Budget to raise taxes 8.3% - largest haul in history

September 8, 2016

The FY2017 Budget for Palm Beach Gardens will be discussed at the first public hearing on September 8.

Property valuations are up significantly this year, and some jurisdictions are reaping large windfalls by leaving their millage flat. The county for example, will see a tax increase of over 8%, which will be their largest budget in history, growing by $60M in new taxes – bigger than the entire budget for PBG.

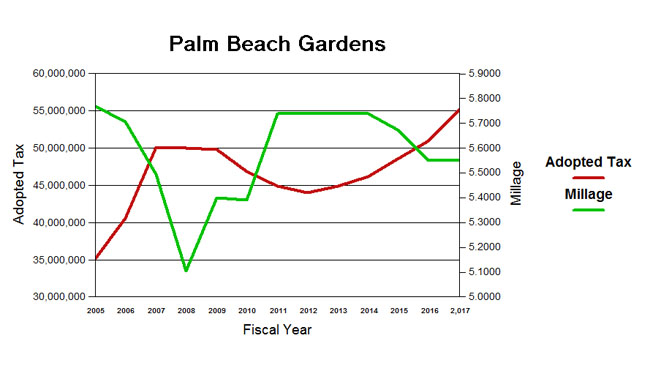

The Gardens Council is apparently as greedy as the county and does not propose to return any of the valuation windfall to the taxpayer. It should be noted that this year’s proposed $55M in revenue is the largest budget to date (an increase of $5M), far exceeding those of the boom years of 2007-2008.

As the included chart shows, when the valuation bubble burst in 2008, PBG increased the millage to maintain flat tax revenue around $50M, then relented in 2009 and let revenue decline below $45M as the economy remained stagnant. Now that there is an increase in valuation (over 8% this year) the proposed flat millage will produce a proportional rise in revenue (on top of 5% last year).

Keep in mind that the proposed sales tax surcharge will return a further windfall to the city if it passes, yet that is hardly mentioned. It would be appropriate for the city to reduce the millage this year and keep the tax increase to a more reasonable level.