$2.5M Tax Increase in 2019 Budget

Posted by Fred Scheibl on September 4, 2018 · Leave a Comment

The 2019 PBG Budget raises $2.5M in new taxes, up 4.3% over last year. See the Proposed Budget here.

When the new budget was introduced to set the millage at the July meeting, it contained a generous increase in reserves, and had led one to hope that there was room for at least a token millage reduction, even with the potential for the passage of Amendment 1 in November. (Amendment 1 would increase the homestead exemption and reduce the tax take of the counties and municipalities.)

That is less likely now, as the Council (with a room full of uniformed officers staring them down) unanimously passed an emergency 12% raise for the Gardens Police in August. This was done with little advance notice and with little discussion, other than that the Sheriff was hiring with big bucks and many of the officers would be leaving the Gardens if they didn’t get more money. The net result (since the maximum millage had already been set) was to fund it from reserves.

You may recall that prior to the passage of the sales tax surcharge in 2016, PBG staff had said they didn’t need any additional sources of funds, and if it passed, would return some to the taxpayers in a millage reduction. That too changed of course when the full 10 year revenue stream was captured in a bond and allocated to projects starting immediately, including $11M for a new park.

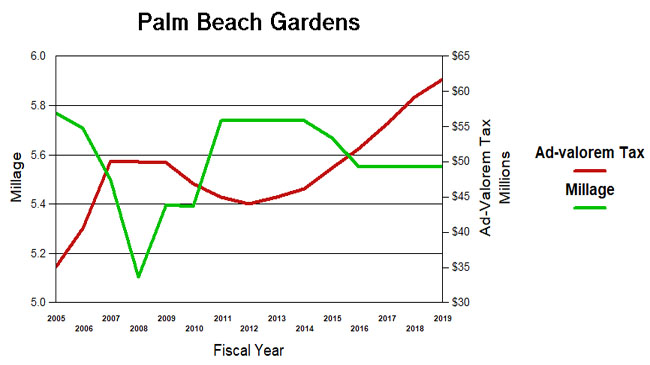

Assuming the flat millage budget is passed, it will raise about $62M in Ad-Valorem taxes, up over 4% from last year. In the last year, inflation has increased by 2.8% and population by about 1.7%, so the increase is not out of line.

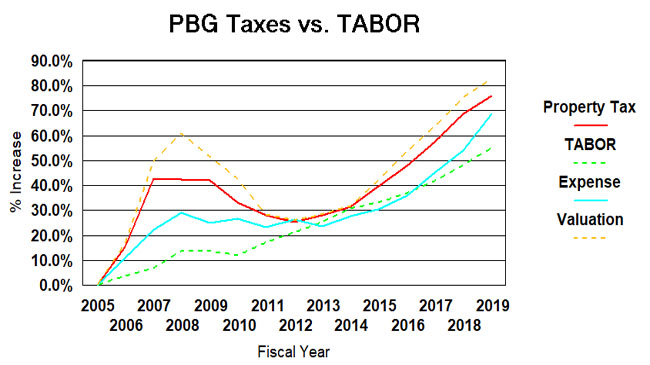

TABOR

In 1992, the state of Colorado amended their constitution to restrict the growth of taxation. Under the “Taxpayer Bill of Rights” (TABOR), state and local governments could not raise tax rates without voter approval and could not spend revenues collected under existing tax rates without voter approval if revenues grow faster than the rate of inflation and population growth. The results of this Colorado experiment are mixed, and TABOR has its pros and cons. (For background on TABOR, see: Taxpayer Bill of Rights ) Population growth and inflation though, would seem to be a way of assessing the appropriateness of the growth of a city budget, at least as an initial benchmark.

Since 2005, the population of Palm Beach Gardens will have grown by about 16% to its 2019 projection of 56,590 (est.) Inflation, measured by the consumer price index, will be about 33%. Taken together, TABOR would suggest a growth in city spending and taxation of about 55%. (see graph below).

Over the same period (2005-2019), ad-valorem taxes grew 76% and total expenditures (budget less debt payment, capital and transfers) grew 69%. Both are above the TABOR line, but note that in 2013, reductions in tax collection had actually returned to the trendline. It is only since then that we seem to be off to the races.

It should be noted that ad-valorem taxes fund only a part of city expenditures, the rest made up from impact fees, fees for services, other taxes, intergovernmental grants, etc. and have varied from 66% of the total in 2005 to about 69% now. That is why taxes and expenses do not track each other on the chart.

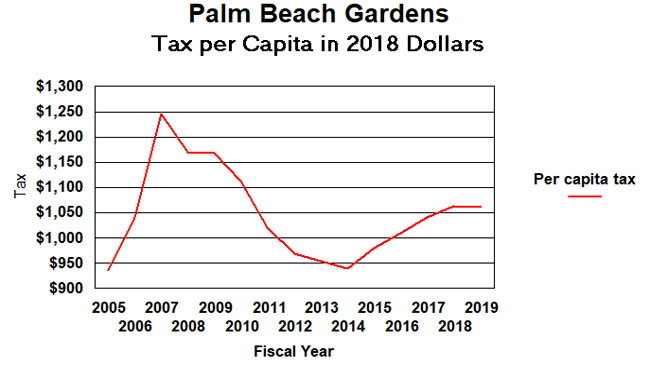

Another useful measurement is taxes per capita – Ad valorem taxes divided by population and then inflation adjusted. By this measure, in 2005 we paid $936 per person to our city and in 2019 it will be $1060 (2018 dollars). It should be noted that as property owners, we pay taxes to other entities besides the city – county, schools, health care district, etc. In 2019 the Palm Beach Gardens portion of the amount on our TRIM statement is about 27% of the total.

So if you trust TABOR, or per-capita as measuring sticks, is this growth in taxation excessive? You be the judge.