Next PBG City Council on Thursday 11/3 at 6pm

The next City Council Meeting will be held in City Hall on Thursday, November 3rd at 6pm. You can watch it livestreaming either during or after the meeting, if you are unable to attend.

Announcements and Presentations include:

- Recognition of PB North Chamber of Commerce

- Partnership Presentations from the PBC Sports Commission and Cressey Sports Performance

Consent Agenda includes:

- Resolution 57, 2022 – Select a date for the January 2023 regular City Council meeting – Thurs Jan 12, 2023

- Resolution 73. 2022 – Authorizing the Mayor to execute any and all documents deemed necessary to abandon an ingress/egress easement.

- Resolution 75, 2022 – Consideration for Approval: A Resolution approving the plat for Avenir — Pod 15 within the Avenir Planned Community Development (PCB).

- Resolution 77, 2022 – Agreement with the Palm Beach County Supervisor of Elections (SOE) for Vote Processing Equipment Use and Election Services Agreement – (note – regarding March Municipal Elections – currently the candidates for Groups 1,3,5 have no opponents which would deem them automatically elected after deadlines have passed)

- Resolution 78, 2022 – Appoint the Supervisor of Elections as the single canvassing board for the March 14, 2023, Municipal Election.

- Purchase Award – Facilities Management Contractors Program – Openly Competed – 5 year contract with option to renew for 5 years – $10 million – “This Agreement will establish a pool of contractors that will provide facilities management services on an as needed basis to the City.”

Public Hearings and Resolutions – New Business

- Resolution 65, 2022 – Site Plan Amendment for the Frenchman’s Creek Clubhouse and Recreation Site – A request by Frenchman’s Creek, Inc. to construct a new 93,155-square-foot clubhouse building and parking lot, and reconfiguration of sport courts within the Frenchman’s Creek Planned Community Development (PCD).

- Resolution 66, 2022 – Site Plan approval for a 250-unit residential townhome subdivision within the Town Center District (Parcel B) of the Avenir Planned Community Development (PCD)

- Resolution 67, 2022 – Site Plan approval for a 144-lot single-family subdivision within Parcel A (Pod 20) of the Avenir Planned Community Development (PCD)

- Resolution 79, 2022 – Operation Sister City — City of Wauchula, Florida.

For Second Reading and Adoption:

- Ordinance 9, 2022 – Amending Chapter 74. Utilities. by repealing Article IV. Water Shortage Regulations in its entirety and readopting Article IV. as revised and with new “landscape Irrigation Conservation Regulations,” to provide far local implementation of the mandatory year-round landscape Irrigation Conservation Measures Rules of the South Florida Water Management District

- Ordinance 10, 2022 – Amendment to the City’s Land Development Regulations, Chapter 78, to create the Transit Oriented Development (TOD) Overlay District.

- Ordinance 11, 2022 – A City-initiated request to amend Chapter 78 – Land Development, Article III — Development Review Procedures, Section 78-54 — Public Notice, Table 4: Required Public Notice to be consistent with the City’s Charter and State Statutes and to allow first-class mailing for all petition types

- Ordinance 12. 2022 – Amending Chapter 66. Taxation. at Article VI. Economic Development Ad Valorem Tax Exemption by repealing Section 66-310. Sunset provision. and readopting same, as revised, to renew the City Council’s authority to grant Property Tax Exemptions to certain qualified businesses pursuant to state law and the City.

- Ordinance 13, 2022 – Amending Chapter 2. Administration by repealing Section 2-294. — Bidding threshold., and readopting same, as revised, in order to amend certain purchasing limits and remove certain reference to state law. (See our summary from the October City Council Mtg.)

- Ordinance 14, 2022 – Amending the City of Palm Beach Gardens Budget for the Fiscal Year Beginning October 1, 2021 and ending September 30, 2022.

Please check the agenda before the meeting for additions or modifications.

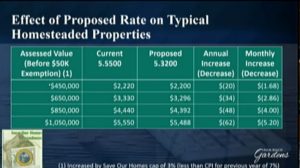

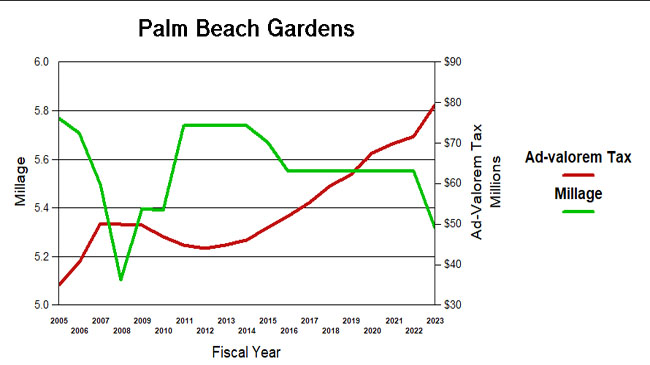

City’s Millage Lowered to 5.32%

The new tax-rate was lowered to 5.32% and the new Fiscal Year 2022/2023 budget raises about $7.8M in new taxes, up a 10.9% over last year’s adopted budget. Both the millage and new budget were approved/adopted on 2nd hearing 5:0 on Sept 22 after being also approved 5:0 at the Sept 8th initial City Council Meeting. Council Member Marciano, with the most in-depth city budget experience on the Council, has long sought to lower millage over the last several years and was pleased to finally have it happen in his last term.

While homesteaded properties will see lowered tax bills, those in non-homesteaded properties will see increases. Budget details can be viewed here.

The ten-year financial forecast assumes flat millage at the new 5.32%. Also of note is that there is no debt service millage and none assumed in the forecast.

Other items from the two September meetings:

-

- Resolution 52, 2022 – passed 5:0 on 9/8 – approving and ratifying a collective bargaining agreement with the Police Benevolent Association for Police Officers, Sergeants, and Communications Operators employed by the City’s Police Department for Fiscal Years 2023- 2025.

- Consent Agendas for both meetings passed 5:0

-

- Public Comment

- 9/8 – Two residents requested waivers regarding screening for roof-top a/c units. Their information was collected by staff;

- Terence Davis, candidate for Florida House District 94 introduced himself

- 9/22 – Tom Cairnes of the Gardens Mall, and PGA Corridor, spoke about upcoming PGA Corridor events

- Public Comment

- City Manager Report:

- 9/8 – National Suicide Prevention Month – a campaign to raise awareness called ‘Card My Yard‘ has placed various encouraging signage around the City

- 9/22 – For the next two weekends there will be construction at the PGA Blvd entrance to the Turnpike in order to remove the toll booths. See details here.

- 9/8 – National Suicide Prevention Month – a campaign to raise awareness called ‘Card My Yard‘ has placed various encouraging signage around the City

- Items for Council Discussion:

-

- 9/8 – All on the council apparently received an email requesting a dog park for PGA National – discussion ensued regarding the difficulties and liabilities associated with dog parks. City Manager Ferris suggested the all wait until they see how the renovations at the Lilac Park dog park work out, specifically the artificial turf, and then raise the topic again in the future.

-

- City Attorney Lohman, on 9/8, gave a brief update on the suit between Palm Beach County and PBG regarding Mobility Fees and said that the City did not request oral argument.

Second of Two Sept City Council Mtgs on Thurs 9/22 at 6pm

The second FY 2022/2023 Budget Hearing will be held at PBC City Hall on Thursday Sept 22 at 6pm. Ordinance 7, 2022 at first hearing passed 5:0. Ordinance 7, 2022 and accompanying Resolution 30, 2022 will finalize and adopt the Budget. You can watch the meeting via livestreaming either during or after the meetings, if you are unable to attend.

The Finance Department prepared a short update on the new budget and the budget details can be viewed here.

Also on the agenda – Consent includes:

- Resolution 55, 2022 – A Resolution approving the plat for Panther National at Avenir Pod 14 within the Avenir Planned Community Development ( PCD).

- Resolution 61, 2022 – Approving a Letter of Agreement between the City’s Fire Rescue Department and the State of Florida’ s Agency for Health Care Administration for Public Emergency Medical Transportation – “Each year, the City is required to execute a Letter of Agreement to participate in the program. In those prior years, the program costs were within the City Manager’ s signatory authority. For fiscal year 2023, the City expects to transfer approximately $ 98, 549.64 to the State and receive reimbursements of $ 158, 664. 92 in return. “

- Resolution 62, 2022 – Authorizing the City Manager to Execute an Agreement between the City of Palm Beach Gardens, Florida, and Station Automation, Inc., DBA PSTrax, for Renewal of the Fire and EMS Asset and Inventory Control Software Agreement for the Fire Rescue Department. Five year contract – annual contract price $14K; Total Contract Price $72K

Please check the agenda before the meeting for additions or modifications.

First of Two Sept City Council Mtgs on Thurs 9/8 at 6pm

There will be two PBG City Council meetings in September due to the first and second public hearings of the 2022/2023 Fiscal Year Budget approval process. The two meetings will be held on Thursday Sept 8 at 6pm and Thursday Sept 22 at 6pm. The change in meeting days are to avoid conflict with other county budget hearings. You can watch the meetings via livestreaming either during or after the meetings, if you are unable to attend.

Announcements and Presentations:

- COLLECTIVE BARGAINING AGREEMENT WITH THE POLICE BENEVOLENT ASSOCIATION – the presentation is regarding Resolution 52, 2022 – A Resolution approving and ratifying a collective bargaining agreement with the Police Benevolent Association for Police Officers, Sergeants, and Communications Operators employed by the City’s Police Department for Fiscal Years 2023- 2025. Resolution 52, 2022 – on consent agenda – $4.745 million through 9/30/25

Consent Agenda – in addition to Resolution 52, includes:

- Purchase Award: Bi-Directional Amplifier Program (Police Dept) – Piggyback/Access contract – upon completion – $265.5K

- Purchase Award: Fleet Leasing Program – Piggyback/Access contract – 2 year contract with option to renew for 1 year – $3 million

- Purchase Award: Office Furniture for City Hall (1st Floor) – Piggyback/Access contract – upon completion – no more than $200K

- Purchase Award: Planning & Zoning File Room Records Scanning Project – Piggyback/Access contract – upon completion – $239K

Public Hearings – Ordinances and Resolutions:

- Ordinance 7, 2022 – First Reading – Adopting the Budget for Fiscal Year 2022/2023

-

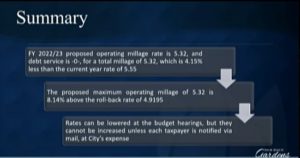

- “This is the first of two required public hearings to set the millage and adopt the budget for Fiscal Year 2022/ 2023. On July 14, 2022, Council approved Resolution 29, 2022, setting the maximum tentative operating millage rate for FY 2022/ 2023 at 5. 3200 mills which is 4. 15 percent less than last year’ s rate of 5. 5500. The proposed operating millage of 5. 3200 is 8. 14 percent above the roll -back rate of 4. 9195. Total sources for all funds are $ 236, 074, 948, consisting of total estimated balances carried forward of $ 76, 175,466 and projected total revenues of $ 159, 899, 482, Total sources of funds are balanced with projected total expenditures of $ 155, 235, 949 and ending reserves of $80, 838, 999, for a total use of funds of $236, 074, 948. The second and final public hearing on the budget is scheduled for September 22, 2022,”

-

- See Fred Scheibl’s analysis “Proposed Tax Increase Accomplished with Lower Millage“.

-

Please check the agenda before the meeting for additions or modifications.

Proposed Tax Increase Accomplished with Lower Millage

The proposed 2023 PBG Budget raises about $7.8M in new taxes, up a 10.9% over last year’s adopted budget. See the Proposed Budget here.

With the millage at 5.32, down from the 5.55 it has been for the last 7 years, this is the eighth year that increases in property valuations and new construction have provided a painless increase in revenue. In 2015, the last year there was a millage reduction, ad-valorem revenue was $49M. This year’s $80M is a 62% increase over the seven years of flat millage.

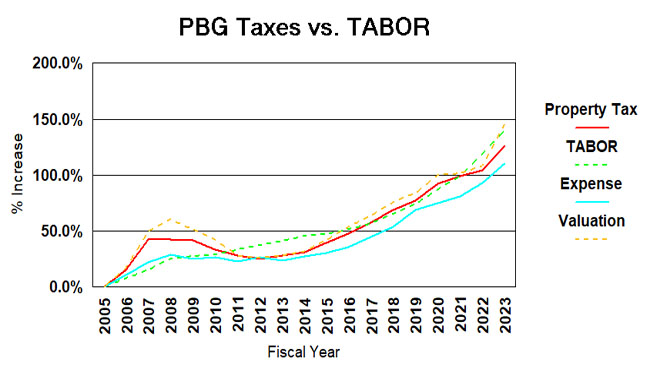

Similar to last year, the 2023 budget needs to be thought of differently because excessive federal spending and money printing by the Federal Reserve has brought us a repeat of the inflationary environment of the ’70s. The Bureau of Labor Statistics tracks the “CONSUMER PRICE INDEX FOR ALL URBAN CONSUMERS (CPI-U)” monthly. In July of this year, that figure stands at 297 – up a whopping 8.8% over one year ago when it was 273. At that rate, we expect a 323 CPI in the middle of the 2023 fiscal year. As you will see in the TABOR comparison, the tax increase is justified in this environment with the Biden Administration continuing to print money like there is no tomorrow.

Projecting out the PBG population estimates from the Bureau of Economic and Business Research (BEBR at UFL), the Gardens population will be just shy of 61K in 2023, up about 1%. The TABOR multiple (Taxpayer Bill of Rights – inflation times population growth) is therefore about 9.8%.

TABOR

In 1992, the state of Colorado amended their constitution to restrict the growth of taxation. Under the “Taxpayer Bill of Rights” (TABOR), state and local governments could not raise tax rates without voter approval and could not spend revenues collected under existing tax rates without voter approval if revenues grow faster than the rate of inflation and population growth. The results of this Colorado experiment are mixed, and TABOR has its pros and cons. (For background on TABOR, see: Taxpayer Bill of Rights ) Population growth and inflation though, would seem to be a way of assessing the appropriateness of the growth of a city budget, at least as an initial benchmark.

Since 2005, the population of Palm Beach Gardens will have grown by about 45% (BEBR estimate – see below) to its estimated 2023 level of 61K. Inflation, measured by the consumer price index, will be about 66%. Taken together, TABOR would suggest a growth in city spending and taxation of about 140%. (see graph below).

Over the same period (2005-2023), ad-valorem taxes grew 126% and total expenditures (budget less capital and transfers) grew 111%. Spending closely follows the TABOR line, and ad-valorem taxes is not widely divergent suggesting spending and taxation appropriate to a growing city.

It should be noted that ad-valorem taxes fund only a part of city expenditures, the rest made up from impact fees, fees for services, other taxes, intergovernmental grants, etc. and have varied from 66% of the total in 2005 to about 70% now. That is why taxes and expenses do not track each other on the chart.

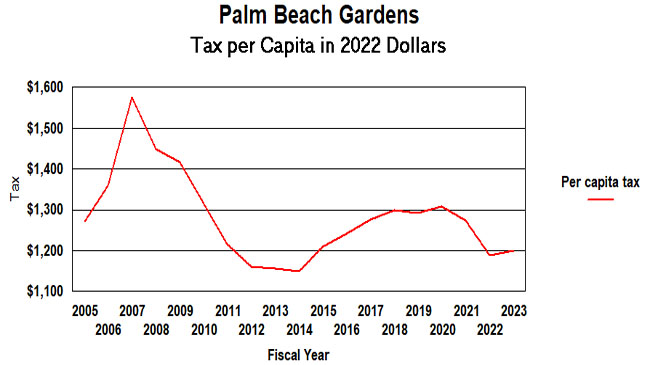

Another useful measurement is taxes per capita – Ad valorem taxes divided by population and then inflation adjusted. By this measure, in 2005 we paid $1,273 per person to our city and in 2022 it will be $1,200 (2022 dollars) – an actual decline. Tax per capita was as low as $1148 in 2014 after a millage reduction. It should be noted that as property owners, we pay taxes to other entities besides the city – county, schools, health care district, etc. In 2021 the Palm Beach Gardens portion of the amount on our TRIM statement is about 27% of the total.

The chart below shows an actual decline in per-capita taxation for two years in a row and then a flattening this year. However, there is reason to believe the BEBR population estimates have missed some of the city’s growth (see below). If the numbers were to be adjusted to match the growth in voter registrations since 2016 for example, the curve would be flatter since there are more people to pay the taxes.

So if you trust TABOR, or per-capita as measuring sticks, this modest growth in taxation (compared to inflation) for 2022 seems appropriate in our view. You be the judge.

A word about population estimates.

Estimates of the Gardens population vary. The numbers used in the preceding two charts are based on the University of Florida’s Bureau of Business and Economic Research (BEBR) data. By their measure, we have grown 42% to 2021 since 2005. The US Census has a slightly different set of numbers and they claim 41% over the same period. (Prior to the 2020 census results they were widely divergent.) BEBR says we had 59,755 residents in 2021. the Census said 59,549. Projecting to 2023 at the same rates would get approximately 60.9K and 60.2K respectively.

BEBR has been more reliable as the census numbers degrade over time. In 2017, the city annexed Osprey Isles and Carleton Oaks and in 2018 Bay Hill and Rustic Lakes. It did not appear that the census adjusts for annexations between decennials. Also, certain areas of the city are growing rapidly, such as Alton and Avenir. This will likely see a faster expansion than the current BEBR or Census trend line.

Avenir Town Center Phases 1 and 2 Get Go-Ahead

The August 4th City Council meeting began with a couple of presentations:

- Noel Martinez, President & CEO, Palm Beach North Chamber of Commerce – described the regional Disaster Resilience Action Plan – developed to ensure that neighborhood businesses are equipped to recover quickly from natural and/or other disasters. The plan development was funded by a grant and was produced with involvement by 10 municipalities and many local businesses. The evolving plan can be seen here.

-

State Senator Bobby Powell – FL Senate District 30 – gave an update on his impressions of the last 2 sessions (regular and special). He also showed an appropriations chart with the municipalities and organizations receiving state funding, $500K of which is going to Palm Beach Gardens for Storm Water System Improvements.

Public Comment – was made by Michael Winter – President and Founder of the Palm Beach North Athletic Foundation – a 501c3 representing the ‘private’ side of funding for the indoor athletic sports-plex planned for Gardens North County District Park.

The City Manager Report included:

-

- The 9th consecutive year that Km! Ra, the Director (and he is the entire) Purchasing Department received the Excellence in Procurement Award. Congratulations!

- Candice Temple, Public Media Relations Director

- Showed a video about the City’s EV charging stations – produced by her intern, Ryan, who just received a degree in video production

- Informed the Council and Public about the availability of the Proposed FY 2022/2023 Budget for viewing via the cloud-based opengov platform and providing the public with a lot of new ways to look at the data. It can be seen here.

The Consent Agenda passed 5:0.

Regular Agenda Ordinances and Resolutions:

- Ordinance 8, 2022 – Adopting New Section 18-1. Minimum Notice for Residential Rental Payment Increases. and New Section 18-2. Penalties. Second reading and adoption 5:0

- Ordinance 9, 2022 – Landscape Irrigation Conservation Regulations – City Attorney Max Lohman – described that the SFWMD had changed to year-round regulations a couple of years ago and created a model ordinance that they wanted to promulgate throughout municipalities in the region. When Council Member Tinsley suggested a couple of modifications, the response by others on the Council and Lohman and City Manager Ferris was that every other city/county are passing the wording unchanged. So First reading passed 5:0 unchanged.

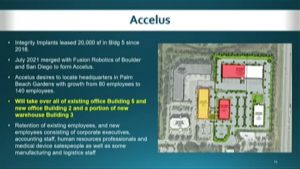

Resolution 45, 2022 – Amendment to the PGA National Commerce Park PUD – New buildings (grand-fathered in) are being added to the site, by Accelus who is moving their headquarters to the site. Public Comment was made by Michelle Composto, Mindy Logue and Tony Pajune – all living in properties directly across from the Commerce Park. Their primary concern was traffic on Northlake between Military Trail and Bee Line Hwy – and did not want any additional development approved until the issues with traffic on Northlake are remedied. There were also issues with landscape buffering. Council and staff explained that the property and assumed traffic was previously approved and the plans actually required less traffic. Additionally – council requested an additional EV charging station and a review of the landscaping/buffering and future Art in Public Places for the Commerce Park. The resolution passed 5:0.

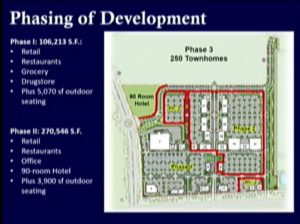

Resolution 45, 2022 – Amendment to the PGA National Commerce Park PUD – New buildings (grand-fathered in) are being added to the site, by Accelus who is moving their headquarters to the site. Public Comment was made by Michelle Composto, Mindy Logue and Tony Pajune – all living in properties directly across from the Commerce Park. Their primary concern was traffic on Northlake between Military Trail and Bee Line Hwy – and did not want any additional development approved until the issues with traffic on Northlake are remedied. There were also issues with landscape buffering. Council and staff explained that the property and assumed traffic was previously approved and the plans actually required less traffic. Additionally – council requested an additional EV charging station and a review of the landscaping/buffering and future Art in Public Places for the Commerce Park. The resolution passed 5:0. Resolution 46, 2022 – site plan approval for phases 1 and 2 of Avenir Town Center – Ken Tuma, Urban Design Studio described the plans for the roughly 52 acre project, which will include many restaurants, a Publix, and pharmacy and is intended to be a vibrant town center which will also serve Ibis and the Acreage, accessible to pedestrians, golf-carts and vehicles. Phase 3 will include 250 townhomes and was not part of the resolution. The Paseo will be a feature with green spaces and walkways – to the center. After a lot of positive discussions, the resolution passed 5:0.

Resolution 46, 2022 – site plan approval for phases 1 and 2 of Avenir Town Center – Ken Tuma, Urban Design Studio described the plans for the roughly 52 acre project, which will include many restaurants, a Publix, and pharmacy and is intended to be a vibrant town center which will also serve Ibis and the Acreage, accessible to pedestrians, golf-carts and vehicles. Phase 3 will include 250 townhomes and was not part of the resolution. The Paseo will be a feature with green spaces and walkways – to the center. After a lot of positive discussions, the resolution passed 5:0.

Proposed millage 5.32, drop of 4.5%!

The biggest news of the evening: After several years of 5.55 millage, the City has proposed a decrease of 4.5% to the proposed 2022/2023 5.32 millage. Allen Owens, Finance Administrator, said that their models also maintain that same lowered millage in their 10 year projections. Council Member Woods expressed concern with the lower millage and looks forward to meeting with staff on the detailed proposed budget. He did point out that after several years of requesting the millage be lowered, Council Member Marciano was not in attendance to vote on the reduction. Vice Mayor Litt asked what homeowners will see and was told even homesteaded properties, capped at 3% increases, will see a reduction. Council Member Tinsley praised the city’s consistent fiscal responsibility. Mayor Reed had to select from all who were eagerly vying to raise and second the motion for Resolution 29, 2022!

The biggest news of the evening: After several years of 5.55 millage, the City has proposed a decrease of 4.5% to the proposed 2022/2023 5.32 millage. Allen Owens, Finance Administrator, said that their models also maintain that same lowered millage in their 10 year projections. Council Member Woods expressed concern with the lower millage and looks forward to meeting with staff on the detailed proposed budget. He did point out that after several years of requesting the millage be lowered, Council Member Marciano was not in attendance to vote on the reduction. Vice Mayor Litt asked what homeowners will see and was told even homesteaded properties, capped at 3% increases, will see a reduction. Council Member Tinsley praised the city’s consistent fiscal responsibility. Mayor Reed had to select from all who were eagerly vying to raise and second the motion for Resolution 29, 2022!

Another exciting item brought to the Council by City Manager Ferris, was that FoxBusiness/Verizon recognized Palm Beach Gardens as one of top 10 small cities for small business! The City came in first in the state and 8th in the nation and is the only small city on the entire east coast to be on the list. Here’s a video specific to the Gardens.

Another exciting item brought to the Council by City Manager Ferris, was that FoxBusiness/Verizon recognized Palm Beach Gardens as one of top 10 small cities for small business! The City came in first in the state and 8th in the nation and is the only small city on the entire east coast to be on the list. Here’s a video specific to the Gardens.

Ordinance 8, 2022 – First reading – requires that landlords give renters 60 days notice prior to rate increases of 5% or more. City Attorney Lohman said that the public will be informed through normal communications channels, as well as providing materials to each of the apartment complexes in the City. Enforcement/penalties will be incident based – eg if a renter has not received the required notice they can bring their complaint to the City.

In other business:

- City Manager Report

- Introduced Madelyn Marconi as the new Administrative Services Manager

- Chief Bessette, Division Chief of EMS, was named to Palm Beach County EMS Advisory Council– his seat is the only one representing all the EMS providers in the County

- The Pickleball center won several grants/awards

- Sandhill Crane Golf Club ranked 4th in Palm Beach County for local public golf courses

- FDOT replied to a request submitted by Council Member Tinsley through the City about the Beeline/Northlake intersection – saying that the bike lane (with traffic going on each side of it), could not be moved and separated from vehicular traffic due to lack of sufficient easement.

- Consent Agenda passed 4:0

- All other Ordinances/Resolutions passed 4:0

- Public Comment was made by

- Gina A. Levesque – Intake and Compliance Manager of the PBC Commission on Ethics giving the Council members information and her card

- Manolo Calvo, who is President of the Soccer division of PBG Youth Athletic Association gave additional updates since he last spoke at the Council in June.

- City Attorney Lohman gave a short update on the lawsuit between the City and Palm Beach County regarding Mobility fees – briefs are being exchanged.

Next City Council Mtg on July 14th at 6pm

The next City Council Meeting will be held in City Hall on Thursday, July 14th at 6pm. You can watch it livestreaming either during or after the meeting, if you are unable to attend.

Consent Agenda includes many items this month. Not all are listed:

- Resolution 7, 2022 – A Resolution approving the plat for Panther National at Avenir within the Avenir Planned Community Development (PCD).

- Resolution 34, 2022 – Agreement with the Palm Beach County Supervisor of Elections (SOE) for Vote Processing Equipment Use and Election Services Agreement for the August 23, 2022, Primary Election. Note – PBG has a Special Election for Referendum Question: CITY OF PALM BEACH GARDENS REFERENDUM QUESTION. AUTHORIZATION TO GRANT ECONOMIC PROPERTY TAX EXEMPTIONS IN ACCORDANCE WITH THE STATE CONSTITUTION

- Resolution 44, 2022 – Ratification and Approval of the City Manager’s Authorization of Additional Expenditure to Complete the LED Lighting Systems Upgrade Project at the Police Department.

- Purchase Award: Architectural Services for Fire Rescue Station No. 6 – Bid Waiver – Contract value including City’s 10% Contingency – $296K

- Purchase Award: Furnish and Install Public Safety Communications Monopole at Avenir – Piggyback/Access Contract – $364K

- Purchase Award: Installation of Synthetic Turfgrass at Lilac Dog Park – Piggyback/Access Contract – $113K

- Purchase Award: Janitorial Supplies and Chemicals – Piggyback/Access Contract – 5 year contract with option to renew for 3 years – $1.2 million

Ordinances and Resolutions – New Business only:

- Ordinance 8, 2022 – First Reading – Amending Chapter 18. Businesses. At Article I. In General by Adopting New Section 18-1. Minimum Notice for Residential Rental Payment Increases. and New Section 18-2. Penalties. “Certain South Florida counties, Miami-Dade and Broward, and cities, including Lake Worth Beach, West Palm Beach, and Miami Beach, have recently enacted ordinances that require 60 days’ written notification be given by residential landlords to their tenants prior to increasing the tenants’ rent beyond 5 percent; therefore, it is necessary, in order to better protect tenants in the City, to establish a required minimum notice period (with which all residential landlords must comply) prior to increasing the rental rate of certain tenants beyond a specific percent.”

- Resolution 33, 2022 – A City-initiated application to submit the City’s Program Year 2022-2023 Annual Action Plan application for the U.S. Department of Housing and Urban Development (HUD) Community Development Block Program (CDBG) funding and a substantial amendment to add an activity to the City’s adopted Program Year 2019-2020 Annual Action Plan.

- Resolution 40, 2022 – A request by Seacoast Utility Authority (SUA) for Site Plan approval to allow the development of a utility maintenance facility. The Seacoast Utility Authority parcel is 2.5 acres and is located on the south side of Avenir Drive, approximately 0.15 miles west of Coconut Boulevard within the Avenir PCD.

- Resolution 29, 2022 – Adopting a proposed maximum millage rate for the City of Palm Beach Gardens for FY 2022/2023, and setting the date, time, and place of the first public budget hearing. “The City is required to file with the County Property Appraiser and Tax Collector a proposed millage rate that will be sent out on the Notice of Proposed Taxes in August. The proposed operating millage rate for FY 2022/2023 is 5.32, which is a reduction to the current year rate of 5.55. Once the tentative millage is filed with the County, these rates can be lowered at the budget hearings, but they cannot be increased. “

- Resolution 32, 2022 – Adopting the Fiscal Year 2022/2023 Fees and Charges Schedule. “Please refer to Exhibit “A” for a comprehensive listing of the proposed changes by department.

Please check the agenda before the meeting for additions or modifications.

Acceleration of Western Fire Station Proposed

If passed on 2nd reading, Ordinance 1, 2022, presented by Allen Owens, Finance Administrator, the annual budget adjustment ordinance includes accelerating the construction of Fire Station 6 in Avenir. The requested allocation of $6 million for the project would be funded by: Restricted Reserves for Other American Rescue Plan $3,744,066, Budget Stabilization Reserve Account 1,055,934, and Fire Impact Fees 1,200,000. The fire station was planned to be funded by a loan in the future, but given projected inflation, staff calculated that building it sooner and without the need for a loan would both save the City money and provide necessary coverage to the western communities earlier. The ordinance also includes the staffing of 8 new full-time employees for the Recreation Department. The Council was supportive of the proposals and Ordinance 1, 2022 passed 5:0.

If passed on 2nd reading, Ordinance 1, 2022, presented by Allen Owens, Finance Administrator, the annual budget adjustment ordinance includes accelerating the construction of Fire Station 6 in Avenir. The requested allocation of $6 million for the project would be funded by: Restricted Reserves for Other American Rescue Plan $3,744,066, Budget Stabilization Reserve Account 1,055,934, and Fire Impact Fees 1,200,000. The fire station was planned to be funded by a loan in the future, but given projected inflation, staff calculated that building it sooner and without the need for a loan would both save the City money and provide necessary coverage to the western communities earlier. The ordinance also includes the staffing of 8 new full-time employees for the Recreation Department. The Council was supportive of the proposals and Ordinance 1, 2022 passed 5:0.

The meeting began with a presentation by Casey Mitchell, Director of Golf. The City’s 2021 15th Annual Mayor’s Golf Classic, is the largest event conducted every year, and coincides with Veteran’s Day. She recognized the 60+ staff and volunteers that made the event a reality, along with the sponsors. Dr. Ronald Williams, Jr., Chief of Staff at the VA Medical Center described how funds are used to help find veterans homes. $72691.11 raised this year.

The Consent Agenda passed 5:0 – with Mayor Litt pulling and reading the Black History Month proclamation, and Vice-Mayor Reed pulling the 211 Awareness Week proclamation and thanking the 211 services in suicide prevention.

In other business:

- Ordinance 2, 2022 – presented by Martin Fitts, Principal Planner, was primarily statutory in nature, however there was an explanation and some discussion about the rationale for removing the Urban Growth Boundary. The ordinance passed on first reading 5:0

- Ordinance 3, 2022 – City Attorney Max Lohman explained that the Council was previously granted, for a ten year period, the ability to abate property taxes for new capital investment satisfying certain qualifications or for existing investments if expanded – to encourage economic development. In the last ten years, the only company qualifying/granted the abatement by the Council was the Carrier Corp. The referendum is to renew the ability, and keeps ‘this tool in the toolbox’. The City will undertake an information program to inform the voters and is the only city question on the August ballot. The ordinance passed 5:0 on first reading.

- Ordinance 4, 2022 – Martin Fitts explained that the ordinance would allow covid testing/vaccination sites to be handled as a special event plus increase the time pumpkins and Christmas trees can be sold. In both topics, this allows for easier handling and approvals for setup and logistics. The ordinance passed 5:0 on first reading.

In Items for Council discussion

- Vice Mayor Reed highlighted a TPA Conference that discussed the Beeline Highway project. (Note: Joel Engelhardt covered a recent zoom meeting on the topic in his article here.)

- Mayor Litt mentioned major activities in February including Artigras and the Honda Classic.

- Council Member Tinsley raised the issue of proposed redistricting maps dividing the City into more than one district. The Council still thought it was too early to raise a concern and weren’t sure whether being represented by more than one district was a good or bad thing.

Flat millage at 5.55 and Outdoor Seating Improvements Passed

The Sept 22 PBG City Council meeting began with remarks by Police Chief Clint Shannon, honoring the four Police Explorers who participated in the annual Florida Association of Police Explorers competition. Palm Beach Gardens won first overall, as well as placing well in specific challenges. The City’s team competed against 20 other Explorer Posts from around the state.

Mayor Litt then segued to the topic of the night, the setting of the millage rate and the FY 2021/2022 Budget. Apparently nerves were struck when the Palm Beach Post questioned sources of funding for the new golf course and/or residents suggested that flat millage in a time of increasing values is a tax increase. So prior to the actual resolution and ordinance discussions, the Mayor described the City’s various reserves, the use of Cares Act funding, the usage made of American Rescue Plan (ARP) funds, and how much of what the City accomplished in giving back to business and residents came from the City’s reserves. The Mayor has posted her commentary on Facebook.

Resolution 36, 2021 – Adopting the Tax Levy and Millage Rate – comprised the bulk of the discussion by Council. Council Members Tinsley and Marciano, as they did at the first hearing, asked the Council to consider a minor reduction in millage to 5.50 to give back to the taxpayers. Mayor Litt, Vice Mayor Reed and Council Member Woods again insisted that they were NOT raising taxes*, that they were giving back to the people and businesses that the City determined really needed it in the midst of a pandemic, highlighted the importance of a ‘stable’ tax rate, and were disappointed that Palm Beach Gardens was not lauded for keeping millage flat, while nearby Lake Park was. (* when property valuations go up and millage remains flat, the $$ you pay in taxes goes up – thus it is a tax increase, however modest). The vote on the millage was 3:2 with Tinsley/Marciano voting NO. See the Palm Beach Post article on the discussion in their article entitled “Palm Beach Gardens narrowly passes budget, OKs using federal grant to help build golf course”

Ordinance 8, 2021 – Adopts the Budget for FY 2021/2022 – no further discussion as the issue was not with the Budget. Vote 5:0

Ordinance 10, 2021 – 2nd Reading and Adoption of the modifications to Outdoor Seating and related parking requirements which passed 5:0 on first hearing. Vote – 5:0

Next month Nick Uhren, Executive Director of the Palm Beach TPA will be giving a presentation about Mobility