Final Fiscal Year 2017/2018 Budget Hearing and Council Mtg – Monday 9/25/17

Agenda Highlights:

- Second Reading and Approval of the 2017/2018 Budget and setting property tax rate

- Second Reading of Ordinances regarding Floodplain Management Regulations

- Ordinance 63, 2017 – A request to allow the shopping center at Downtown at the Gardens (DTAG) within Regional Center Planned Community Development to have a total of 36 special events per calendar year that is 24 more than the maximum permitted by Section 78-187 of the City's Code

City Manager Report – no details listed

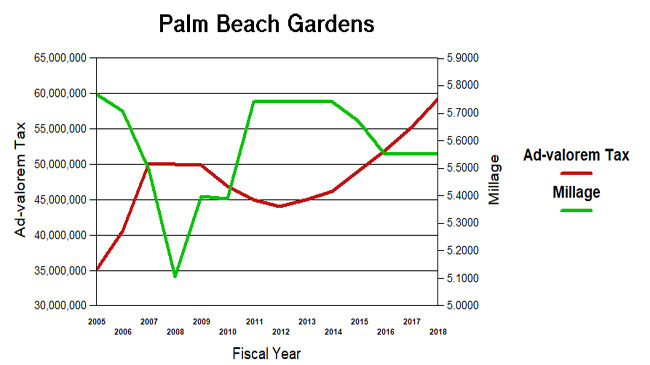

- Resolution 58, 2017/Ordinance 19, 2017 – the proposed operating millage rate for Fiscal Year 2017/2018 is 5.5500 mills and a debt service millage rate of .1178. The proposed operating millage rate of 5.5500 is 5.37% above the roll-back of 5.2671 . When combined, the total operating and debt service millage rate proposed for Fiscal Year 2017/2018 is 5.6678 mills, which is .18% below the current year combined rate of 5.6781 mills. (Note: PBG Watch comment: This millage will raise $59M in taxes, an increase of $4.1M over last year’s $55M, up 7.4%. (Note that we compare the budget figures, not the calculated “rollback rate” which overstates last year’s budget.) The sales surtax provides another $3M windfall each year.)

- Ordinances 15 and 18, 2017 – 2nd Reading and adoption. A City-initiated request to amend Chapter 78, Land Development, in order to repeal the previously adopted and now outdated Floodplain Regulations from Chapter 78 and to amend Chapter 86, Buildings and Building Regulations to add the revised Floodplain Regulations. The proposed amendments will provide consistency with the Florida Division of Emergency Management's Model Ordinance.

Check the agenda to see if any additional items have been added before the meeting here.

We get the government we deserve – and it’s up to us to watch what they do. Hope you can make it. If you can’t make the meeting try and watch live-streaming or on-demand.

First Budget Hearing and Sept City Council Mtg on Thurs 9/7

Agenda Highlights:

- First Hearing 2017/2018 Budget and setting property tax rate

- New Ordinance prohibiting Medical Marijuana facilities in the City

- Final Approval of Ordinance on the Operation of Mobile Food Trucks

- Resolution 59, 2017 – Ratifying the Collective Bargaining Agreement with the SEIU/FLORIDA PUBLIC SERVICES UNION (FPSU) for fiscal years 2017-2020; Employees' base salaries were increased as a result of being placed in a new, updated salary plan, effective October 1, 2017. In addition, all employees will receive a 3 percent increase to base salary effective October 1st each year of the contract: 2017, 2018, and 2019.

- Purchase Award for Renewal of Microsoft Enterprise License for 3 years – Piggyback/Access Contract for $417K

- Purchase Award for Landscaping for the New Golf Clubhouse – Landscape contract is for 1 time $175K – using an existing vendor with the City

City Manager Report – no details listed

- Ordinance 17, 2017 – First Reading and First Public Hearing Adopting the Fiscal Year 2017/2018 Budget.. The proposed budget holds Operating Millage flat at 5.55 mills. The total operating and debt service millage rate proposed for Fiscal Year 2017/2018 is 5.6678 mills, which is less than the current year combined rate of 5.6781 mills. See our post on the growth of the proposed budget along with a link to the Proposed Budget page. The second and final public hearing on the budget is scheduled for September 25, 2017.

- Ordinance 22, 2017 – First Reading of Ban of Medical Marijuana Treatment Facilities and Dispensaries – amending Chapter 78 Land Development Regulations to prohibit such facilities in the city. The staff analysis outlines the rationale for the proposed ordinance.

- Ordinance 23, 2017 – First Reading of Temporary Moratorium through December 31, 2017 on Micro Wireless Facilities: on the submittal and processing of applications and the issuance of any permits pertaining to the collocation on existing or the creation of new utility poles in the City-owned rights-of-way to support small or micro wireless facilities for a period ending December 31, 2017.

- Resolution 55, 2017 – Art in Public Places for La Posada

- Resolution 60, 2017 – Approving a FPL Watts Substation site-plan on 5-acre utility parcel in the NE corner of Alton PCD.

- Ordinances 15 and 18, 2017 – A City-initiated request to amend Chapter 78, Land Development, in order to repeal the previously adopted and now outdated Floodplain Regulations from Chapter 78 and to amend Chapter 86, Buildings and Building Regulations to add the revised Floodplain Regulations. The proposed amendments will provide consistency with the Florida Division of Emergency Management's Model Ordinance.

- Ordinance 17, 2017 – Mobile Food Trucks – second reading and adoption of the new permit requirements approved on first reading in August

Check the agenda to see if any additional items have been added before the meeting here.

The PBG Budget and the Taxpayer Bill of Rights (TABOR)

The 2018 PBG Budget raises $4.1M in new taxes, up 7.4% over last year. See the Proposed Budget here.

Prior to the passage of the sales tax surcharge last year, PBG staff had said they didn’t need the money, and if passed, would return some to the taxpayers in a millage reduction. That all changed of course when the full 10 year revenue stream was captured in a bond and allocated to projects starting immediately, including $11M for a new park.

As the new budget is considered, so far only Vice Mayor Mark Marciano, following in the Bert Premuroso tradition, has suggested they consider a millage decrease. The rest, along with staff, plan to proceed for the third year with the millage rate set in 2016 at 5.55.

This millage will raise $59M in taxes, an increase of $4.1M over last year’s $55M, up 7.4%. (Note that we compare the budget figures, not the calculated “rollback rate” which overstates last year’s budget.) The sales surtax provides another $3M windfall each year.

Is this growth in taxes (and expenditures) justified by the growth of Palm Beach Gardens? How much taxation is enough?

In 1992, the state of Colorado amended their constitution to restrict the growth of taxation. Under the “Taxpayer Bill of Rights” (TABOR), state and local governments could not raise tax rates without voter approval and could not spend revenues collected under existing tax rates without voter approval if revenues grow faster than the rate of inflation and population growth. The results of this Colorado experiment are mixed, and TABOR has its pros and cons. (For background on TABOR, see: Taxpayer Bill of Rights ) Population growth and inflation though, would seem to be a way of assessing the appropriateness of the growth of a city budget, at least as an initial benchmark.

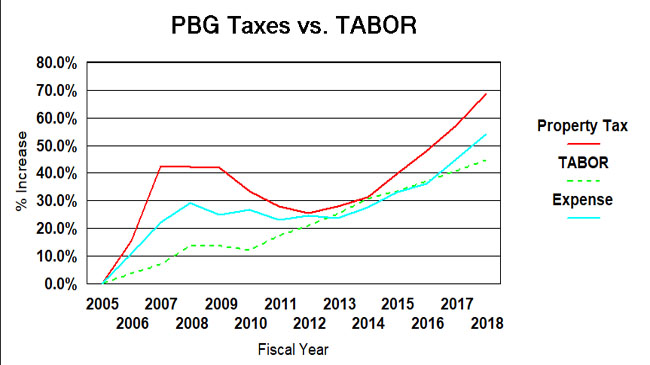

Since 2005, the population of Palm Beach Gardens has grown by about 14% to its current 55,637 (est.) Inflation, measured by the consumer price index, was 26%. Taken together, TABOR would suggest a growth in city spending and taxation of about 45%. (see graph below).

Over the same period, ad-valorem taxes grew 69% and total expenditures (budget less debt payment, capital and transfers) grew 54%. Both are above the TABOR line, but note that in 2013, reductions in tax collection had actually returned to the trendline. It is only since then that we seem to be off to the races.

It should be noted that ad-valorem taxes fund only a part of city expenditures, the rest made up from impact fees, fees for services, other taxes, intergovernmental grants, etc. and have varied from 66% of the total in 2005 to about 73% now. That is why taxes and expenses do not track each other on the chart.

So if you trust TABOR as a measuring stick, is this growth in taxation excessive? You be the judge.