Flat millage at 5.55 and Outdoor Seating Improvements Passed

The Sept 22 PBG City Council meeting began with remarks by Police Chief Clint Shannon, honoring the four Police Explorers who participated in the annual Florida Association of Police Explorers competition. Palm Beach Gardens won first overall, as well as placing well in specific challenges. The City’s team competed against 20 other Explorer Posts from around the state.

Mayor Litt then segued to the topic of the night, the setting of the millage rate and the FY 2021/2022 Budget. Apparently nerves were struck when the Palm Beach Post questioned sources of funding for the new golf course and/or residents suggested that flat millage in a time of increasing values is a tax increase. So prior to the actual resolution and ordinance discussions, the Mayor described the City’s various reserves, the use of Cares Act funding, the usage made of American Rescue Plan (ARP) funds, and how much of what the City accomplished in giving back to business and residents came from the City’s reserves. The Mayor has posted her commentary on Facebook.

Resolution 36, 2021 – Adopting the Tax Levy and Millage Rate – comprised the bulk of the discussion by Council. Council Members Tinsley and Marciano, as they did at the first hearing, asked the Council to consider a minor reduction in millage to 5.50 to give back to the taxpayers. Mayor Litt, Vice Mayor Reed and Council Member Woods again insisted that they were NOT raising taxes*, that they were giving back to the people and businesses that the City determined really needed it in the midst of a pandemic, highlighted the importance of a ‘stable’ tax rate, and were disappointed that Palm Beach Gardens was not lauded for keeping millage flat, while nearby Lake Park was. (* when property valuations go up and millage remains flat, the $$ you pay in taxes goes up – thus it is a tax increase, however modest). The vote on the millage was 3:2 with Tinsley/Marciano voting NO. See the Palm Beach Post article on the discussion in their article entitled “Palm Beach Gardens narrowly passes budget, OKs using federal grant to help build golf course”

Ordinance 8, 2021 – Adopts the Budget for FY 2021/2022 – no further discussion as the issue was not with the Budget. Vote 5:0

Ordinance 10, 2021 – 2nd Reading and Adoption of the modifications to Outdoor Seating and related parking requirements which passed 5:0 on first hearing. Vote – 5:0

Next month Nick Uhren, Executive Director of the Palm Beach TPA will be giving a presentation about Mobility

2nd Sept City Council Mtg and Final FY 2021/2022 Budget Hearing on Wed 2/22 at 6pm

The final required Budget Hearing for the Fiscal Year 2021/2022 PBG City Budget will be held on Wed., Sept 22 at 6pm. The first hearing was held on Wed, 9/8. See our summary of the first meeting: “Same Old Budget Hearing But Innovations on Outdoor Restaurant Seating“. The agenda is fairly short. If you can’t make the meeting, you can watch it livestreamed or after the fact.

Presentations:

- Palm Beach Gardens Police Explorers – First Place at State Competition – this was postponed from a prior council meeting.

Consent Agenda includes:

- Purchase Award – Property and Casualty Insurance Program – Openly competed – 2yr contract with no option to renew – $3.6 million dollars

Public Hearings and Resolutions:

- Resolution 36, 2021 – Adopting the tax levy and millage rate

- Ordinance 8, 2021 – 2nd reading and adoption of the budget for FY 2021/2022

- Ordinance 10, 2021 – 2nd reading and adoption of the modifications to Outdoor Seating and related parking requirements which passed 5:0 on first hearing.

Please check the agenda before the meeting for additions or modifications.

Same Old Budget Hearing But Innovations on Outdoor Restaurant Seating

The City Council held its first FY 2021/2022 Budget Hearing. Despite compelling arguments from both Council Members Marciano and Tinsley to slightly lower the proposed millage to 5.50 from 5.55, Mayor Litt, Vice-Mayor Reed and Council Member Woods voted to raise taxes. As has been the same every year, since 2015 – which is the last time millage was lowered, various council members pride themselves on holding taxes flat. Except in rare times of flat or lowering valuations, this is UNTRUE. Flat millage with raising valuations is A TAX INCREASE. Scoffing at the concept of a discussion over savings to the hypothetical house valued at $450K of $20, they seemed to forget that the money comes from the people, and as Marciano said (and has said in the past) – the purpose of the city government is not to be a bank. This is our money. Public comment was made by resident Mary Lynn Manning requesting that the millage be set to the rollback rate. She added that while understanding that the city had no oversight of the schools, that without first rate schools the outstanding city would be lacking. That said – the final vote to keep millage flat was 4:1 with Council Member Marciano voting No. Ordinance 8, 2021, approving the proposed budget on first hearing passed 5:0.

Read Joel Englehardt’s On Gardens Post entitled Palm Beach Gardens Tax Revolt Fails by One Vote, for a blow by blow description of the budget portion of the meeting. Here is also a link to Finance Director Allan Owens’ presentation.

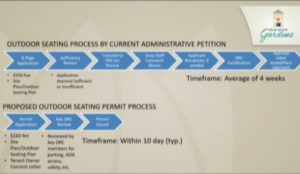

Ordinance 10, 2021 introduced a proposal, presented by Martin Fitts, Principal Planner, planning division, to modernize and streamline the process for outdoor restaurant seating and related parking requirements. The public’s preferences for outdoor dining choices as a result of Covid-19 and different types of dining venues, led the City to review it’s current policies. The current process to request outdoor seating by administrative petition takes about 4 weeks and costs $550. The proposed process would be a permit process costing $150 with more liberal options for the restaurants and their locations. The proposal was met with strong approval by the council. The primary concern was to make sure that restaurants affected by the current procedures expiring on Sept 30 be informed and be allowed sufficient time to qualify under the new permitting process. Planning and Zoning Director Natalie Crowley assured the council that everyone would be informed and she praised Mr. Fitts for his work. The ordinance passed 5:0

Ordinance 10, 2021 introduced a proposal, presented by Martin Fitts, Principal Planner, planning division, to modernize and streamline the process for outdoor restaurant seating and related parking requirements. The public’s preferences for outdoor dining choices as a result of Covid-19 and different types of dining venues, led the City to review it’s current policies. The current process to request outdoor seating by administrative petition takes about 4 weeks and costs $550. The proposed process would be a permit process costing $150 with more liberal options for the restaurants and their locations. The proposal was met with strong approval by the council. The primary concern was to make sure that restaurants affected by the current procedures expiring on Sept 30 be informed and be allowed sufficient time to qualify under the new permitting process. Planning and Zoning Director Natalie Crowley assured the council that everyone would be informed and she praised Mr. Fitts for his work. The ordinance passed 5:0

Other business:

- Ordinance 9, 2021 passed 5:0 on second reading/adoption – it passed 5:0 on first reading last month

- Charlotte Brzezinkski Leisure Services Administrator announced several honors received by the Parks and Recreation department and specifically called out Wendy Tatum, Director of Tennis & Pickleball and Andi Mohl, Recreation Supervisor – Tennis Business Operations for the Tennis Center’s receiving of a 2021 USTA (US Tennis assoc) Outstanding Facility Award. Also several staff members received the CPI (certified parks and recreation professional designation): Daniel Prieto, deputy leisure services administrator, Andi Mohl, tennis operations manager and earlier (due to covid) Tim Ford, Monette Preston and Ashley Shipman.

- Mayor Litt acknowledged Firefighter Christina Krakowski and Jodi Kalish, Police Officer for their part in the podcast ‘The Woman Effect’ making it in a male dominated industry by/for Palm Beach North Chamber.

- City Attorney Max Lohman said that the city was progressing with its Mobility case with the county – filing answers and counter-claims (the city counter sued county), described some discovery issues and scheduling depositions.

- City Manager Ferris said that the latest interlocal agreement with the County had been submitted regarding the Bayhill/Northlake traffic signal and that the County should give approval and the City was ready to go next week with installing the signal.

The next council meeting will be held on Wednesday September 22 at 6pm – primarily as the 2nd Reading and Adoption of the millage and the FY 2021/2022 Budget.

First Budget Hearing and City Council Mtg on Wednesday, 9/8 at 6pm.

There will be two PBG City Council meetings in September due to the first and second public hearings of the 2021/2022 Fiscal Year Budget approval process. The two meetings will be held on Wednesday Sept 8 at 6pm and Wednesday Sept 22. The change in meeting days are to avoid conflict with other county budget hearings. See our related analysis of the proposed budget “PBG 3.3% Tax Increase Actually Less than Inflation“. If you can’t make the meeting, you can watch it livestreamed or after the fact.

Presentations include various recognition for Parks and Recreation.

Consent Agenda includes:

- Resolution 52, 2021: A Resolution approving the plat for National Express Wash Northlake, located on the north side of Northlake Boulevard, approximately 200 feet west of Sunrise Drive

- Purchase Award – Lease of Backhoe and Skid Steers – Piggyback/Access Contract – 3 yrs with no option to renew – total contract – $152K

- Purchase Award – Stop Loss Insurance – “Stop loss insurance is used by the City to support the goals of the self-funded Group Health Insurance Program and to mitigate large insurance claims” – openly competed. One year contract with option to renew 5 times (1x each year) – $560K

Public Hearings – Ordinances and Resolutions:

- Ordinance 8, 2021 – On July 15, 2021 , Council approved Resolution 29, 2021 , setting the maximum tentative operating millage rate for FY 2021/2022 at 5.55 mills which is the same as last year. The proposed operating millage of 5.55 is 2.3 percent above the roll-back rate of 5.4253. Total sources for all funds are $217,591 ,100, consisting of total estimated balances carried forward of $63,896,629 and projected total revenues of $153,694,471 . Total sources of funds are balanced with projected total expenditures of $153,321,554 and ending reserves of $64,269,546, for a total use of funds of $217,591,100. The second and final public hearing on the budget is scheduled for September 22, 2021. See our post (mentioned above), as well as Joel Englehardt’s piece entitled “Gardens Budget: What You Pay and Where It Goes “

- Ordinance 9, 2021 – 2nd reading and Adoption – An amendment to Chapter 66. Taxation at Sections 66-59 and 66-60 of the City’s Code of Ordinances. 1st reading passed 5:0 on August 5th City Council Mtg

- Ordinance 10, 2021 – 1st reading – A City-initiated request to amend Chapter 78 – Land Development, Article V – Supplementary District Regulations, Section 78-191 – Outdoor Seating and Section 78-345 – Number of parking spaces required. City Manager Ferris had said awhile back that the city planned to see if changes could be proposed to outdoor seating. “These updates are based on a shift in dining preferences by restaurant guests to dine outside and recognize changes in transportation preferences to include mobility options. Based on these environmental changes, City Staff has identified certain areas within the outdoor seating and parking codes that could be modernized. Additionally, Staff has streamlined the outdoor seating approval process to a permit process, similar to the current Special Event permit process, that is simpler for applicants to apply for, faster on average for review, and more cost efficient than the current approval process. The proposed changes will allow more flexibility for restaurant owners and staff in reviewing and approving outdoor seating within the City.”

Please check the agenda before the meeting for additions or modifications.

PBG 3.3% Tax Increase Actually Less than Inflation

The proposed 2021 PBG Budget raises about $2.3M in new taxes, up a modest 3.3% over last year. See the Proposed Budget here.

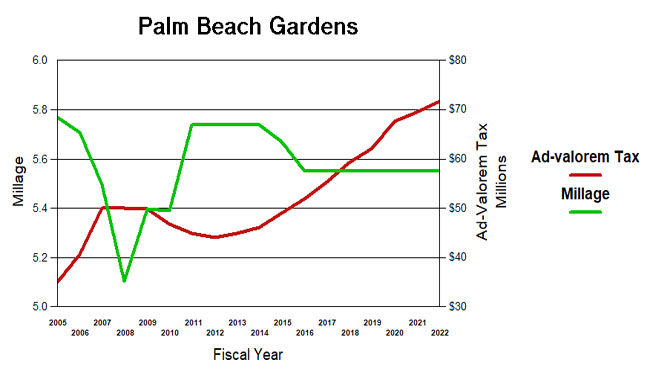

With the millage flat at 5.55 since reduced to that level in 2016, this is the seventh year that increases in property valuations and new construction have provided an equivalent increase in revenue without raising the tax rate. In 2015, ad-valorem revenue was $49M. This year’s $72M is a 46% increase over the six years of flat millage.

Unlike the six years previous, the 2022 budget needs to be thought of differently because excessive federal spending and money printing by the Federal Reserve has brought us a repeat of the inflationary environment of the ’70s. The Bureau of Labor Statistics tracks the “CONSUMER PRICE INDEX FOR ALL URBAN CONSUMERS (CPI-U)” monthly. In July of this year, that figure stands at 273 – up a whopping 5.4% over one year ago when it was 259. It has been climbing at a yearly rate in excess of 5% for the last 3 months, and was up 4.2% in April. In prior budget years, inflation was negligible compared to increases in the ad valorem tax. Let’s assume it continues for another 9 months and the July 2022 figure is 288. Adjusting the tax increase for inflation, the $72M becomes $68M in 2021 dollars – a $1.4M decrease (-2%) in Ad Valorem taxes.

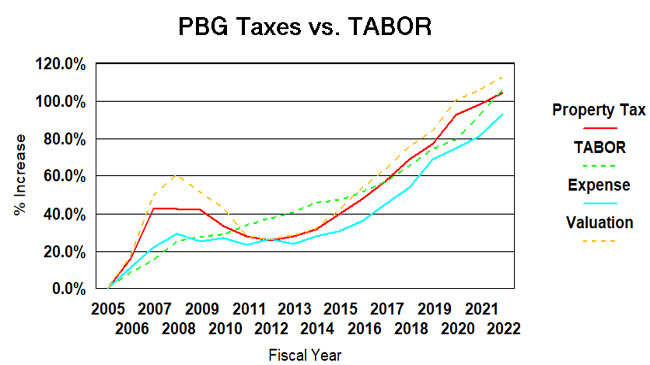

Projecting out the PBG population estimates from the Bureau of Economic and Business Research (BEBR at UFL), the Gardens population will be just shy of 59K in 2022, up about 2%. The TABOR multiple (Taxpayer Bill of Rights – inflation times population growth) is therefore about 7.5%.

TABOR

In 1992, the state of Colorado amended their constitution to restrict the growth of taxation. Under the “Taxpayer Bill of Rights” (TABOR), state and local governments could not raise tax rates without voter approval and could not spend revenues collected under existing tax rates without voter approval if revenues grow faster than the rate of inflation and population growth. The results of this Colorado experiment are mixed, and TABOR has its pros and cons. (For background on TABOR, see: Taxpayer Bill of Rights ) Population growth and inflation though, would seem to be a way of assessing the appropriateness of the growth of a city budget, at least as an initial benchmark.

Since 2005, the population of Palm Beach Gardens will have grown by about 40% (BEBR estimate – see below) to its estimated 2022 level of 59K. Inflation, measured by the consumer price index, will be about 48%. Taken together, TABOR would suggest a growth in city spending and taxation of about 107%. (see graph below).

Over the same period (2005-2021), ad-valorem taxes grew 104% and total expenditures (budget less debt payment, capital and transfers) grew 93%. Spending closely follows the TABOR line, and ad-valorem taxes is not widely divergent (although exceeding TABOR since 2017) suggesting spending and taxation appropriate to a growing city.

It should be noted that ad-valorem taxes fund only a part of city expenditures, the rest made up from impact fees, fees for services, other taxes, intergovernmental grants, etc. and have varied from 66% of the total in 2005 to about 70% now. That is why taxes and expenses do not track each other on the chart.

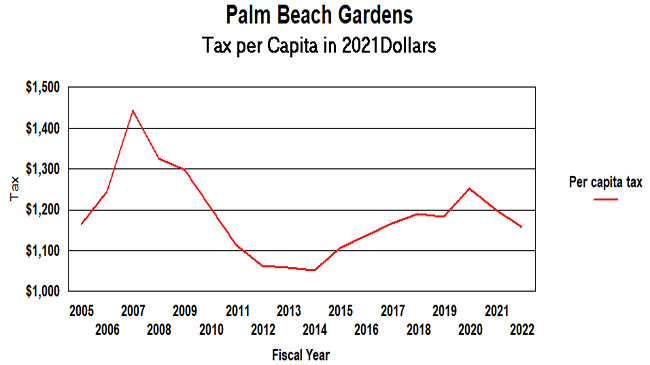

Another useful measurement is taxes per capita – Ad valorem taxes divided by population and then inflation adjusted. By this measure, in 2005 we paid $1,170 per person to our city and in 2022 it will be $1,154 (2021 dollars) – an actual decline. Tax per capita was as low as $1056 in 2014 after a millage reduction. It should be noted that as property owners, we pay taxes to other entities besides the city – county, schools, health care district, etc. In 2021 the Palm Beach Gardens portion of the amount on our TRIM statement is about 27% of the total.

The chart below shows an actual decline in per-capita taxation for two years in a row. However, there is reason to believe the BEBR population estimates have missed some of the city’s growth (see below). If the numbers were to be adjusted to match the growth in voter registrations since 2016 for example, the curve would be flatter since there are more people to pay the taxes.

So if you trust TABOR, or per-capita as measuring sticks, this modest growth in taxation for 2021 seems appropriate in our view. You be the judge.

A word about population estimates.

Estimates of the Gardens population vary. The numbers used in the preceding two charts are based on the University of Florida’s Bureau of Business and Economic Research (BEBR) data. By their measure, we have grown 34.6% to 2020 (the last number given) since 2005. The US Census has a different set of numbers and they claim 39% over the same period. BEBR says we had 56,709 residents in 2020. the Census said 58,410. Projecting to 2021 at the same rates would get approximately 59K and 60K respectively.

I have reason to believe that both of these estimates are too low. In 2017, the city annexed Osprey Isles and Carleton Oaks (about 650 residents) and in 2018 Bay Hill and Rustic Lakes (aobut 1340 residents). It is not clear that either BEBR or the census adjusts for annexations between census decennials. Also, certain areas of the city are growing rapidly, such as Alton and soon Avenir.