City’s Millage Lowered to 5.32%

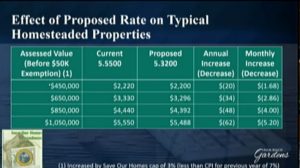

The new tax-rate was lowered to 5.32% and the new Fiscal Year 2022/2023 budget raises about $7.8M in new taxes, up a 10.9% over last year’s adopted budget. Both the millage and new budget were approved/adopted on 2nd hearing 5:0 on Sept 22 after being also approved 5:0 at the Sept 8th initial City Council Meeting. Council Member Marciano, with the most in-depth city budget experience on the Council, has long sought to lower millage over the last several years and was pleased to finally have it happen in his last term.

While homesteaded properties will see lowered tax bills, those in non-homesteaded properties will see increases. Budget details can be viewed here.

The ten-year financial forecast assumes flat millage at the new 5.32%. Also of note is that there is no debt service millage and none assumed in the forecast.

Other items from the two September meetings:

-

- Resolution 52, 2022 – passed 5:0 on 9/8 – approving and ratifying a collective bargaining agreement with the Police Benevolent Association for Police Officers, Sergeants, and Communications Operators employed by the City’s Police Department for Fiscal Years 2023- 2025.

- Consent Agendas for both meetings passed 5:0

-

- Public Comment

- 9/8 – Two residents requested waivers regarding screening for roof-top a/c units. Their information was collected by staff;

- Terence Davis, candidate for Florida House District 94 introduced himself

- 9/22 – Tom Cairnes of the Gardens Mall, and PGA Corridor, spoke about upcoming PGA Corridor events

- Public Comment

- City Manager Report:

- 9/8 – National Suicide Prevention Month – a campaign to raise awareness called ‘Card My Yard‘ has placed various encouraging signage around the City

- 9/22 – For the next two weekends there will be construction at the PGA Blvd entrance to the Turnpike in order to remove the toll booths. See details here.

- 9/8 – National Suicide Prevention Month – a campaign to raise awareness called ‘Card My Yard‘ has placed various encouraging signage around the City

- Items for Council Discussion:

-

- 9/8 – All on the council apparently received an email requesting a dog park for PGA National – discussion ensued regarding the difficulties and liabilities associated with dog parks. City Manager Ferris suggested the all wait until they see how the renovations at the Lilac Park dog park work out, specifically the artificial turf, and then raise the topic again in the future.

-

- City Attorney Lohman, on 9/8, gave a brief update on the suit between Palm Beach County and PBG regarding Mobility Fees and said that the City did not request oral argument.

Second of Two Sept City Council Mtgs on Thurs 9/22 at 6pm

The second FY 2022/2023 Budget Hearing will be held at PBC City Hall on Thursday Sept 22 at 6pm. Ordinance 7, 2022 at first hearing passed 5:0. Ordinance 7, 2022 and accompanying Resolution 30, 2022 will finalize and adopt the Budget. You can watch the meeting via livestreaming either during or after the meetings, if you are unable to attend.

The Finance Department prepared a short update on the new budget and the budget details can be viewed here.

Also on the agenda – Consent includes:

- Resolution 55, 2022 – A Resolution approving the plat for Panther National at Avenir Pod 14 within the Avenir Planned Community Development ( PCD).

- Resolution 61, 2022 – Approving a Letter of Agreement between the City’s Fire Rescue Department and the State of Florida’ s Agency for Health Care Administration for Public Emergency Medical Transportation – “Each year, the City is required to execute a Letter of Agreement to participate in the program. In those prior years, the program costs were within the City Manager’ s signatory authority. For fiscal year 2023, the City expects to transfer approximately $ 98, 549.64 to the State and receive reimbursements of $ 158, 664. 92 in return. “

- Resolution 62, 2022 – Authorizing the City Manager to Execute an Agreement between the City of Palm Beach Gardens, Florida, and Station Automation, Inc., DBA PSTrax, for Renewal of the Fire and EMS Asset and Inventory Control Software Agreement for the Fire Rescue Department. Five year contract – annual contract price $14K; Total Contract Price $72K

Please check the agenda before the meeting for additions or modifications.

First of Two Sept City Council Mtgs on Thurs 9/8 at 6pm

There will be two PBG City Council meetings in September due to the first and second public hearings of the 2022/2023 Fiscal Year Budget approval process. The two meetings will be held on Thursday Sept 8 at 6pm and Thursday Sept 22 at 6pm. The change in meeting days are to avoid conflict with other county budget hearings. You can watch the meetings via livestreaming either during or after the meetings, if you are unable to attend.

Announcements and Presentations:

- COLLECTIVE BARGAINING AGREEMENT WITH THE POLICE BENEVOLENT ASSOCIATION – the presentation is regarding Resolution 52, 2022 – A Resolution approving and ratifying a collective bargaining agreement with the Police Benevolent Association for Police Officers, Sergeants, and Communications Operators employed by the City’s Police Department for Fiscal Years 2023- 2025. Resolution 52, 2022 – on consent agenda – $4.745 million through 9/30/25

Consent Agenda – in addition to Resolution 52, includes:

- Purchase Award: Bi-Directional Amplifier Program (Police Dept) – Piggyback/Access contract – upon completion – $265.5K

- Purchase Award: Fleet Leasing Program – Piggyback/Access contract – 2 year contract with option to renew for 1 year – $3 million

- Purchase Award: Office Furniture for City Hall (1st Floor) – Piggyback/Access contract – upon completion – no more than $200K

- Purchase Award: Planning & Zoning File Room Records Scanning Project – Piggyback/Access contract – upon completion – $239K

Public Hearings – Ordinances and Resolutions:

- Ordinance 7, 2022 – First Reading – Adopting the Budget for Fiscal Year 2022/2023

-

- “This is the first of two required public hearings to set the millage and adopt the budget for Fiscal Year 2022/ 2023. On July 14, 2022, Council approved Resolution 29, 2022, setting the maximum tentative operating millage rate for FY 2022/ 2023 at 5. 3200 mills which is 4. 15 percent less than last year’ s rate of 5. 5500. The proposed operating millage of 5. 3200 is 8. 14 percent above the roll -back rate of 4. 9195. Total sources for all funds are $ 236, 074, 948, consisting of total estimated balances carried forward of $ 76, 175,466 and projected total revenues of $ 159, 899, 482, Total sources of funds are balanced with projected total expenditures of $ 155, 235, 949 and ending reserves of $80, 838, 999, for a total use of funds of $236, 074, 948. The second and final public hearing on the budget is scheduled for September 22, 2022,”

-

- See Fred Scheibl’s analysis “Proposed Tax Increase Accomplished with Lower Millage“.

-

Please check the agenda before the meeting for additions or modifications.

Proposed Tax Increase Accomplished with Lower Millage

The proposed 2023 PBG Budget raises about $7.8M in new taxes, up a 10.9% over last year’s adopted budget. See the Proposed Budget here.

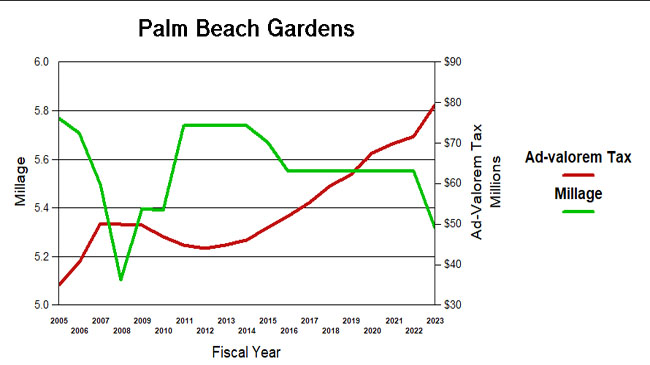

With the millage at 5.32, down from the 5.55 it has been for the last 7 years, this is the eighth year that increases in property valuations and new construction have provided a painless increase in revenue. In 2015, the last year there was a millage reduction, ad-valorem revenue was $49M. This year’s $80M is a 62% increase over the seven years of flat millage.

Similar to last year, the 2023 budget needs to be thought of differently because excessive federal spending and money printing by the Federal Reserve has brought us a repeat of the inflationary environment of the ’70s. The Bureau of Labor Statistics tracks the “CONSUMER PRICE INDEX FOR ALL URBAN CONSUMERS (CPI-U)” monthly. In July of this year, that figure stands at 297 – up a whopping 8.8% over one year ago when it was 273. At that rate, we expect a 323 CPI in the middle of the 2023 fiscal year. As you will see in the TABOR comparison, the tax increase is justified in this environment with the Biden Administration continuing to print money like there is no tomorrow.

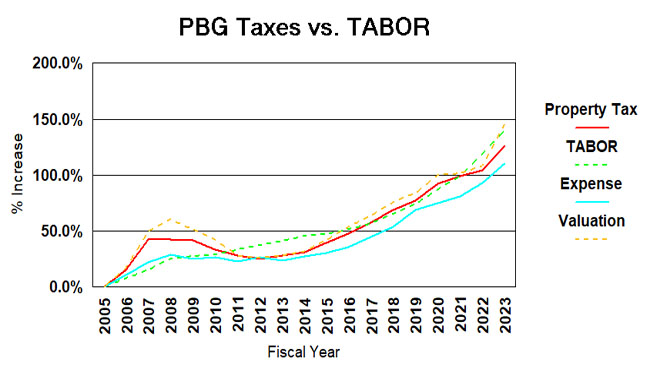

Projecting out the PBG population estimates from the Bureau of Economic and Business Research (BEBR at UFL), the Gardens population will be just shy of 61K in 2023, up about 1%. The TABOR multiple (Taxpayer Bill of Rights – inflation times population growth) is therefore about 9.8%.

TABOR

In 1992, the state of Colorado amended their constitution to restrict the growth of taxation. Under the “Taxpayer Bill of Rights” (TABOR), state and local governments could not raise tax rates without voter approval and could not spend revenues collected under existing tax rates without voter approval if revenues grow faster than the rate of inflation and population growth. The results of this Colorado experiment are mixed, and TABOR has its pros and cons. (For background on TABOR, see: Taxpayer Bill of Rights ) Population growth and inflation though, would seem to be a way of assessing the appropriateness of the growth of a city budget, at least as an initial benchmark.

Since 2005, the population of Palm Beach Gardens will have grown by about 45% (BEBR estimate – see below) to its estimated 2023 level of 61K. Inflation, measured by the consumer price index, will be about 66%. Taken together, TABOR would suggest a growth in city spending and taxation of about 140%. (see graph below).

Over the same period (2005-2023), ad-valorem taxes grew 126% and total expenditures (budget less capital and transfers) grew 111%. Spending closely follows the TABOR line, and ad-valorem taxes is not widely divergent suggesting spending and taxation appropriate to a growing city.

It should be noted that ad-valorem taxes fund only a part of city expenditures, the rest made up from impact fees, fees for services, other taxes, intergovernmental grants, etc. and have varied from 66% of the total in 2005 to about 70% now. That is why taxes and expenses do not track each other on the chart.

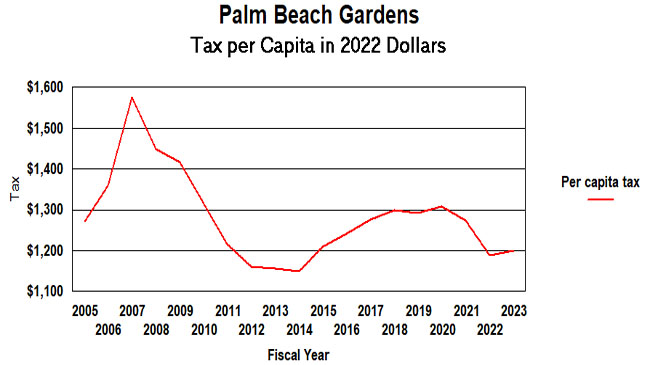

Another useful measurement is taxes per capita – Ad valorem taxes divided by population and then inflation adjusted. By this measure, in 2005 we paid $1,273 per person to our city and in 2022 it will be $1,200 (2022 dollars) – an actual decline. Tax per capita was as low as $1148 in 2014 after a millage reduction. It should be noted that as property owners, we pay taxes to other entities besides the city – county, schools, health care district, etc. In 2021 the Palm Beach Gardens portion of the amount on our TRIM statement is about 27% of the total.

The chart below shows an actual decline in per-capita taxation for two years in a row and then a flattening this year. However, there is reason to believe the BEBR population estimates have missed some of the city’s growth (see below). If the numbers were to be adjusted to match the growth in voter registrations since 2016 for example, the curve would be flatter since there are more people to pay the taxes.

So if you trust TABOR, or per-capita as measuring sticks, this modest growth in taxation (compared to inflation) for 2022 seems appropriate in our view. You be the judge.

A word about population estimates.

Estimates of the Gardens population vary. The numbers used in the preceding two charts are based on the University of Florida’s Bureau of Business and Economic Research (BEBR) data. By their measure, we have grown 42% to 2021 since 2005. The US Census has a slightly different set of numbers and they claim 41% over the same period. (Prior to the 2020 census results they were widely divergent.) BEBR says we had 59,755 residents in 2021. the Census said 59,549. Projecting to 2023 at the same rates would get approximately 60.9K and 60.2K respectively.

BEBR has been more reliable as the census numbers degrade over time. In 2017, the city annexed Osprey Isles and Carleton Oaks and in 2018 Bay Hill and Rustic Lakes. It did not appear that the census adjusts for annexations between decennials. Also, certain areas of the city are growing rapidly, such as Alton and Avenir. This will likely see a faster expansion than the current BEBR or Census trend line.