Next City Council Mtg on Thursday 10/3 at 7pm

The October City Council Meeting will be held on Thursday, 10/3 at 7pm at City Hall.

Highlights include two presentations which should be of interest to drivers in the area:

- I-95/Central Boulevard Interchange project – FDOT Project No 413265-01-52-01

- Northlake Boulevard Signal Timing

The Consent agenda does not include any purchase orders or resolutions

Public Hearings and Resolutions include:

- Ordinance 18, 2019 – Second reading and adoption of the tree trimming and removal ordinance passed in the Sept. 5 city council meeting

- Resolution 59, 2019 – Lease of Self-Contained Breathing Apparatus (SCBA) Air Packs for the Fire Rescue Department from Ten-8 Fire Equipment, Inc. and financed through JP Morgan Chase Bank. The current SCBA air packs are almost 16 years old, do not comply with the new NFPA standards, and will reach the end of their useful life later this year. The City will own the SCBA air packs at the end of the seven-year lease term. Amount of lease – $91K

- Resolution 60, 2019 – Award of a Public Private Partnership Agreement with Palm Beach North Athletic Foundation, Inc. for the Development of an Indoor Recreational Facility at the Gardens North County District Park in the City of Palm Beach Gardens, Florida. The City seeks a long-term partner as part of a public private partnership that has the resources and ability to develop and operate the facility. The City shall not commit any type of public financial resources or guarantee any credit or financing for the facility for this Project.

- Several resolutions for appointments and re-appoints to the following boards: Art in Public Places Advisory Board; Parks and Recreation Advisory Board; Planning, Zoning and Appeals Board; Fire Pension Board.

Check the agenda to see if any additional items have been added before the meeting here.

Finance Director Argues 8.8% Tax Increase Needed

The primary reason for the second City Council meeting in September is always because of the Final Hearing and Approval of the next year’s millage (tax rate) and budget. Finance Director Allan Owens gave a presentation seemingly designed to rebut Mayor Marciano’s position that the millage could be reduced from 5.55 to 5.50. Positions taken by the Council remained unchanged from First Reading – with Council Members Woods, Marino, Litt and Lane making various statements in support of keeping millage flat, and Mayor Marciano restating that “government should do as much as it can with as little as it can”. Always lost in the discussion, especially when pointing out the minimal dollar amount of the increases (whether City, School Board, County Commission) is that is it is the tax-payer’s money – not the government’s. Pennies here and pennies there do add up. Claims that holding a tax rate flat while valuations go up is not raising taxes when the actual tax dollars taken in are going up 8.8% is disingenuous. Read our analysis of the 2019/2020 Budget – 8.8% Tax Increase in 2020 Proposed Budget.

Not surprising, then, that Resolution 61, 2010 – Adopting A Tax Levy and Millage Rate passed 4:1 with the mayor voting No. The associated 2019/2020 Budget (Ordinance 20, 2019) passed 5:0 since there was no point in Mayor Marciano voting no on the actual budget once the millage had passed.

The meeting began with a crowded hall – filled with members and supporters of the PickleBall Athletic Club. After Mayor Marciano pointed out that the issues three members raised were not policy, and thus not related to the Council, City Manager Ferris asked the group to meet with Charlotte Presensky (Leisure Services Administrator) and members of her staff in the lobby.

Also making public comment was PBG resident Laurie French, PBGYAA Secy and Executive Board member thanking the City for the Soccer Fields in Gardens District Park.

The City Manager Report included:

- Candice Temple, Media Relations Manager, described the Bahamian Hurricane Dorian Relief Effort joint partnership with Chris Fellowship – see here for more information and how to help.

- City Manager Ferris gave a heart-felt, touching tribute to recently deceased long-time employee and Navy veteran Robin (”Smitty) Smith.

Ordinance 19, 2019 – adopting the City’s Mobility Fee Schedule drew public comment from a representative from Palm Beach County Planning. Khurshid Mohyuddin, Principal Planner, Transportation Planning. He asked that the City wait until the County held a county wide workshop in 2020. It was pointed out that the City’s Mobility Plan had already been approved at the last City Council meeting and that this ordinance was only codifying the fees.

Resolution 68, 2019 included details of the Model Home Row and Enhanced Entry Features for Avenir Pod 4. This subdivision will have separate Model Home Row designed to minimize any impact to construction areas. The homes will range in price from approximately $800K-$1.2 million. The resolution passed 5:0.

There was no City Attorney report. The next City Council Meeting will be held on October 3 at 7pm.

Next City Council Mtg on Thursday, Sept 19

The next City Council Meeting will be on Thursday Sept 19 at 7pm. This meeting will include the Final Hearing and Adoption of the Fiscal Year 2019/2020 Budget as well as other items.

Consent Agenda includes:

- Purchase Award for Systems Furniture for the renovated/expanded areas of the City Complex. Piggyback/Access contract for $372K

Ordinances and Resolutions include:

- Resolution 61, 2019 – Adopting a tax levy and millage rate for the City of Palm Beach Gardens for the Fiscal Year commencing October 1, 2019, and ending September 30, 2020 and associated Ordinance 20, 2019 – Public Hearing for Second and Final Reading Adopting the Fiscal Year 201 9/2020 Budget.

- Ordinance 19, 2019 – Second reading and adoption of a City-initiated request to amend Chapter 78 of the City’s Code of Ordinances to incorporate a new Impact Fee Schedule for the City of Palm Beach Gardens Mobility Fee to be applied and assessed in the Mobility Fee Assessment Area in lieu of Transportation (Road) Impact Fees, pursuant to the adoption of the City’s Mobility Plan

- Resolution 67, 2019 – while publicly noticed, this resolution Avenir – Site Plan 1 Pods 1 and 3 model homes, model home row, and upgraded entry features has been requested to be postponed by the applicant. It will be opened for public comment and after the public hearing is closed, it will be postponed.

- Resolution 68, 2019 – Avenir Site Plan #1 – Pod 4 Site Plan Amendment Approval – to approve architectural models, design and diversity criteria for custom built homes, a model home row, and an enhanced entry feature for residential Pod 4 that is in Site Plan #1

Check the agenda to see if any additional items have been added before the meeting here.

Mayor Marciano – Gardens Should Lead by Reducing the Millage

First reading of the annual Budget typically results in discussion by the Council, and this year was no exception. See 8.8% Tax Increase in 2020 Proposed Budget and the Palm Beach Post article for more details about the budget specifics. After the Powerpoint presentation made by Finance Director Allan Owens, Mayor Marciano kicked off his analysis of the proposed budget. Unlike the remainder of the Council, the Mayor was previously on the Budget Review Committee (see report here) for several years prior to being elected to the Council and has an in-depth knowledge of the City’s finances not apparent in the others on the Council. He once again echoed former Mayor Bert Premuroso (also knowledgeable on budget matters).

Marciano proposed that the millage be cut to 5.50 rather than the staff recommended 5.55. The Mayor described the uses of the Budget Stabilization Reserve Fund which have strayed from its original intent when created, for critical items, to cover useful but not critical budget items as they come up during the year. Staff always projects depletion of the Fund, but somehow it always ends up having many times the original $500K balance intended when formed. Marciano pointed out that while the City may be run efficiently as is a business, it is NOT a business and it’s goal is to provide critical needs for the taxpayer. He also said that the City has lowered millage in the past, and if it can’t do so in good times – when will it? He stated that Palm Beach Gardens should lead by example, as it prides itself on doing in other areas, and lower millage. Lowering the rate from 5.55 to 5.50 is of minimal impact to the City but is giving money back to the taxpayer.

Others on the Council did not discuss the points specifically made by Marciano but echoed fears of potential disasters (which is what the $23 million Reserve Fund is for), and in some cases displayed ignorance of how a taxpayers’ total tax bill is calculated. The vote was 4:1 and the Mayor remained open to further discussion. (PBG Watch is in total support of lowering the millage to 5.50)

In other business:

- State Representative Rick Roth gave a Legislative Update, postponed from an earlier Council meeting..

- All Ordinances and Resolutions, other than the Fiscal Year 2019/2020 Budget, passed 5:0 with minimal discussion by Council.

- Public Comment was made by Tom Cairnes of PGA Corridor about upcoming meetings, and by Steen Ericksson, representing the Fire Chiefs Association of Palm Beach County inviting people to the 9/11 Remembrance Ceremony at Christ Fellowship Church in Boynton Beach at 7pm.

- Additionally – during discussion of the Purchase Award for Gasoline and Diesel Fuel, pulled from Consent by Council Member Lane – it became apparent that the Burns Rd Public Works Property was removed from the market and the pending sale last mentioned in PBGWatch after the May City Council meeting fell through. For more details – see Resolution 55, 2019.

The next City Council Meeting will be held on Thursday September 19, 2019 at 7pm – and includes the Final Hearing and vote on the Fiscal Year 2019/2020 Budget and millage rate.

8.8% Tax Increase in 2020 Proposed Budget

The proposed 2020 PBG Budget raises $5.5M in new taxes, up whopping 8.8% over last year. See the Proposed Budget here.

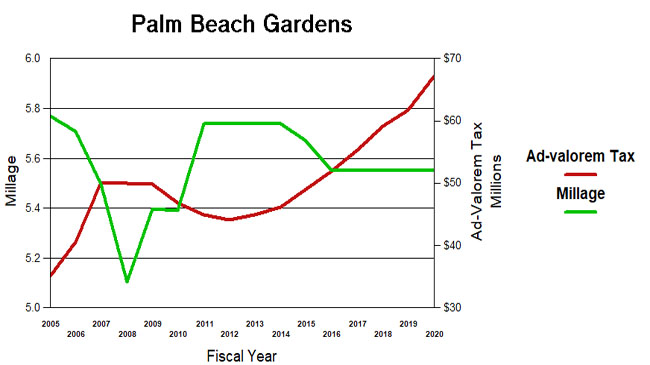

With the millage flat at 5.55 since reduced to that level in 2016, this is the fifth year that increases in property valuations and new construction have flowed money into the city coffers without having to say they “raised taxes”. In 2015, ad-valorem revenue was $49M. This year’s $67M is a 38% increase in tax haul over 5 years.

If you add in the effect of the 10 year 1% sales tax surcharge which gives the city about another $3M per year, the increase over 2015 is actually 67%.

You may recall that prior to the passage of the sales tax surcharge in 2016, PBG staff had said they didn’t need any additional sources of funds, and if it passed, would return some to the taxpayers in a millage reduction. That too changed of course when the full 10 year revenue stream was captured in a bond and allocated to projects starting immediately, including $11M for a new park.

Assuming the flat millage budget is passed, the 8.8% tax increase compares to an increase in population of about 2.3% and about 2% inflation, so the increase is about twice what economic conditions would expect. A token decrease in millage to 5.50 suggested by Mayor Marciano (representing about $600K), would still produce taxes far above what population and inflation would suggest.

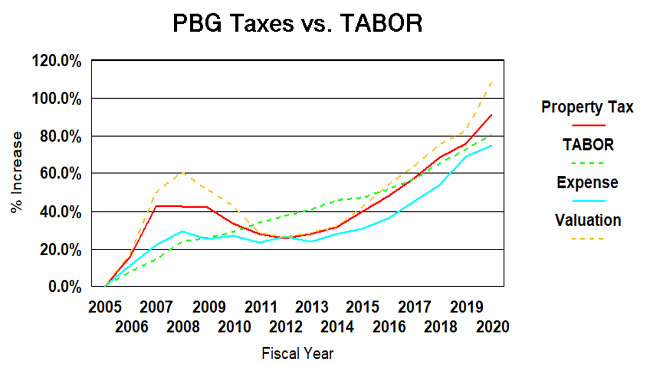

TABOR

In 1992, the state of Colorado amended their constitution to restrict the growth of taxation. Under the “Taxpayer Bill of Rights” (TABOR), state and local governments could not raise tax rates without voter approval and could not spend revenues collected under existing tax rates without voter approval if revenues grow faster than the rate of inflation and population growth. The results of this Colorado experiment are mixed, and TABOR has its pros and cons. (For background on TABOR, see: Taxpayer Bill of Rights ) Population growth and inflation though, would seem to be a way of assessing the appropriateness of the growth of a city budget, at least as an initial benchmark.

Since 2005, the population of Palm Beach Gardens will have grown by about 34% (BEBR estimate – see below) to its 2020 level of 56K. Inflation, measured by the consumer price index, will be about 35%. Taken together, TABOR would suggest a growth in city spending and taxation of about 80%. (see graph below).

Over the same period (2005-2020), ad-valorem taxes grew 91% and total expenditures (budget less debt payment, capital and transfers) grew 75%. Spending closely follows the TABOR line, and ad-valorem taxes is not widely divergent (although exceeding TABOR since 2014) suggesting spending and taxation appropriate to a growing city.

It should be noted that ad-valorem taxes fund only a part of city expenditures, the rest made up from impact fees, fees for services, other taxes, intergovernmental grants, etc. and have varied from 66% of the total in 2005 to about 73% now. That is why taxes and expenses do not track each other on the chart.

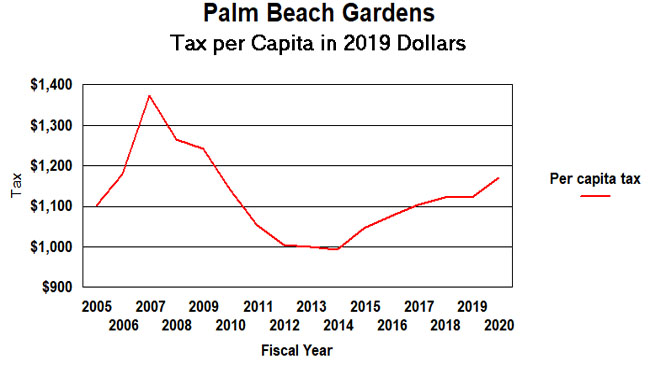

Another useful measurement is taxes per capita – Ad valorem taxes divided by population and then inflation adjusted. By this measure, in 2005 we paid $1,101 per person to our city and in 2020 it will be $1,122 (2019 dollars). Although not too far above the 2005 level, tax per capita was as low as $994 in 2014 after a millage reduction. It should be noted that as property owners, we pay taxes to other entities besides the city – county, schools, health care district, etc. In 2019 the Palm Beach Gardens portion of the amount on our TRIM statement is about 27% of the total.

The chart below shows a steady growth in per-capita taxation, yet there is reason to believe the BEBR population estimates have missed some of the city’s growth (see below). If the numbers are adjusted to match the growth in voter registrations since 2016 for example, the curve is much flatter since there are more people to pay the taxes.

So if you trust TABOR, or per-capita as measuring sticks, is this growth in taxation appropriate? You be the judge.

A word about population estimates.

Estimates of the Gardens population vary. The numbers used in the preceding two charts are based on the University of Florida’s Bureau of Business and Economic Research (BEBR) data. By their measure, we have grown 33.6% since 2005, and 2.3% in the last year. The US Census has a different set of numbers and they claim 37.3% and 1.4% respectively. BEBR says we will have 56,302 residents next April, the Census says 57,860.

I have reason to believe that both of these estimates are too low. In 2017, the city annexed Osprey Isles and Carleton Oaks (about 650 residents) and in 2018 Bay Hill and Rustic Lakes (aobut 1340 residents). It is not clear that either BEBR or the census adjusts for annexations between census decinnials. Also, certain areas of the city are growing rapidly, such as Alton.

If you look at voter registration data, assuming that the population as a whole was growing at the same rate as the voter rolls, you see more rapid growth. In 2016 there were 37,878 registered voters in the Gardens, 74% of the population based on BEBR. By 2019, the voter rolls had grown to 44,847, up 18%. A similar ratio applied to population would yield 61,013 residents in 2019, and by extension, 65,028 in 2020. Precinct 1190 (which includes Alton) now has about 4300 voters. In 2014 it had about 2500.

Next City Council Mtg on Thursday, September 5 at 7pm

We hope that this post finds you and your loved ones safe from Hurricane Dorian. Assuming that all is well on Thursday and nothing changes, the next City Council Meeting will be on Thursday, September 5th at 7pm in City Hall.

Presentations include:

- FL State Representative Rick Roth – with a Legislative Update

Consent Agenda includes:

- Resolution 57, 2019 – Terminating the City’s lnterlocal Agreement with Palm Beach County for Traffic Concurrency Certification Review – The City of Palm Beach Gardens has prepared a Mobility Plan and Fee Report as provided by Section 163.3180 (5) (i), Florida Statutes. Accordingly, the City’s lnterlocal Agreement with Palm Beach County setting forth the procedure for review of Traffic Concurrency Applications is no longer necessary and is recommended to be terminated Second Reading and Adoption of the Mobility Plan is Ordinance 16, 2019 on the Regular Agenda.

- Purchase award – Tires and Related Services – Piggyback/access contract for 3 years with no option to renew – $330K

- Purchase award – Gasoline and Diesel Fuel – Piggyback/access contract for 3 years with option to renew ‘Per State of FL Contract’ – $2 million

Public Hearings and Resolutions – New Business/First Readings includes:

- Ordinance 18, 2019 – First reading – A City-initiated request to amend Division 8. Landscaping of the City’s Land Development Regulations to add a definition of Residential Property to conform to recently approved legislation. Of interest to owners of residential property in the Gardens: On June 26, 2019, the Governor signed into law the Committee Substitute of House Bill 1159, amending Section 163.045, Florida Statutes, relating to tree trimming, pruning, and removal on residential property. Specifically, the bill prohibits a local government from requiring a notice, application, approval, permit, fee, or mitigation for pruning, trimming, or removal of a tree on residential property if the property owner obtains documentation from an arborist certified by the International Society of Arboriculture or a Florida-licensed landscape architect that the tree presents a danger to persons or property. The bill further prohibits a local government from requiring a tree to be replanted if the tree was pruned, trimmed, or removed for this reason.

- Ordinance 19, 2019 – First reading – A City-initiated request to amend Chapter 78 of the City’s Code of Ordinances to incorporate a new Impact Fee Schedule for the City of Palm Beach Gardens Mobility Fee to be applied and assessed in the Mobility Fee Assessment Area in lieu of Transportation (Road) Impact Fees, pursuant to the adoption of the City’s Mobility Plan. (Ordinance 16, 2019 – to be approved earlier in the agenda)

- Ordinance 20, 2019 – Public Hearing for First Reading of Ordinance 20, 2019 Adopting the Fiscal Year 201 9/2020 Budget.

BACKGROUND: This is the first of two required public hearings to set the millage and adopt the budget for Fiscal Year 2019/2020. On July 11 , 2019, Council approved Resolution 39, 2019, setting the maximum tentative operating millage rate for FY 2019/2020 at 5.55 mills. The proposed operating millage of 5.55 is 4.19% above the roll-back rate of 5.3268. The total operating millage rate proposed for Fiscal Year 2019/2020 is 5.55 mills, which is less than the current year rate of 5.6003 mills.

Total sources for all funds is $175,554,209, consisting of total estimated balances carried forward of $47,981,051 and projected total revenues of $127,573,158. Total sources of funds are balanced with projected total expenditures of $128,858,551 and ending reserves of $46,695,658, for a total use of funds of $175,554,209.

The second and final public hearing on the budget is scheduled for September 19, 2019. For more details see the 2019/2020 Proposed Budget page.

Check the agenda to see if any additional items have been added before the meeting here.