Participate in the 2020 Census! and more…

Here are some highlights from the January 9, 2020 City Council Meeting.

Announcement and Presentations:

- Rich Bartholemew of the League of Women Voter’s urged the Council and City to inform the residents of the importance of the 2020 Census. He noted that notifications will start coming in the mail on March 12. And for the first time, people will be asked to respond by phone or electronic devices – including computers/smartphones, as well as the traditional mail. Those who haven’t responded will receive in-person visits in the May time-frame.

- Ken Kennerly, Executive Director and Andrew George, Tournament Director of Honda Classic gave an update on the impacts of the 2019 Honda Classic both to the marketing of Palm Beach Gardens and direct impacts through Honda Classic Cares to charities in South FL, and updates on the upcoming Honda Classic.

Public Comment was made by residents:

- Ed Dolezal – speaking about 5G technology. He has made comment on the topic before, but this time was requesting that the City form an advisory board to explore the health and wellness issues. Mayor Marciano said this was really a Tallahassee issue since state preempts the local municipalities.

- Alan Goldberg and his daughter Sheryl Wysockey, residents and proprietors of a small hot dog stand “Chicago Hot Dogs” in front of Home Depot, on Northlake Dr. spoke on code enforcement and the inability to advertise adequately in PBG. Even with permits – can only stand somewhere with visibility for 6 days a year! He’s willing to pay more for more days. The codes, as written, discourages the mom and pop, small businesses.

Consent Agenda:

While the Consent Agenda passed 5:0, Mayor Marciano pulled Resolution 10, 2020 for discussion – this was the culmination of the discussion from the prior two City Council meetings to create a resolution in support of the Senate Bill 182 and any companion bills. While Marciano and Vice-Mayor Litt have stated many times that this resolution is primarily in support of Home Rule – they also have voiced their support for the banning of single use bags and polystyrene materials. At some point, this ‘issue’ will surely arise in future Council meetings – and the impacts on business and residents. Stay informed!

All other ordinances and resolutions passed 5:0

City Attorney Lohman requested authorization (5:0) to counter sue Sears should the need arise between the January and February Council meetings, in the ongoing dispute between the entities. See Palm Beach Post’s “Palm Beach Gardens to Sears, Gardens Mall: See You in Court”.

Next City Council Meeting on January 9th at 7pm

The first 2020 Palm Beach Gardens City Council Meeting will be on Thursday Jan 9 at 7pm.

Announcements and Presentations include:

- League of Women Voter’s Committee regarding the Census in Palm Beach County

- Honda Classic Community Impact Presentation

Public Hearings and Ordinances include:

- Ordinance 1, 2020 – First reading of the 2020 Budget Amendment – An amendment to the Fiscal Year 2019/2020 budget to adjust fund balance carryovers to actual amounts; re-appropriate amounts committed from the FY 2018/2019 budget for outstanding purchase orders and open projects; and for other purposes. After the amendments are made, the General Fund Budget Stabilization Reserve Account will total $1,664,638 in FY 2020. Unassigned General Fund Reserves total $25,500,000, which is a net increase of $2,433,894 and represents 27.8% of Expenditures.

- Ordinance 2, 2020 – City-initiated Comprehensive Plan Amendments – First Public Hearing and Transmittal City-initiated Comprehensive Text Amendments to the Future Land Use, Transportation·, Infrastructure, Intergovernmental Coordination, Capital Improvements, and Public School Facilities Elements related to the Palm Beach County School Board lnterlocal Agreement; update of the 5-Year Schedule of Capital Improvements; a new Vision Zero related policy; an update of Map A.4-Potential Future Annexation to include recently completed annexations; and the update of the City’s 10-Year Water Supply Facilities Work Plan. Here is a link to the ordinance since there are many alterations to the above items in the comprehensive plan!

- Resolution 4, 2020 – A request by Avenir Holdings, LLC for a Planned Community Development (PCD) Amendment to the Master Plan to relocate 100,000 square feet of medical office square footage from Parcel C – Workplace/Economic Development to Parcel D – workplace; to relocate 155,000 square feet of commercial retail square footage from Parcel B – Town Center to Parcel D – Workplace; to modify an approved Parcel D driveway location; and to amend the list of permitted uses to include Emergency health care/ department and Recreation, outdoor private. The subject site is 4,763 acres and is generally located on the north side of Northlake Boulevard, east of Grapeview Boulevard, west of Bay Hill Drive, and south of Beeline Highway.

- Resolution 8, 2020 – Regional Center Planned Community Development (PCD) Miscellaneous Amendment, Public Hearing and Consideration for Approval: A request for approval to strike Condition of Approval 8 of Resolution 68, 2003 to allow for a future ground-floor tenant sign for the Parcel 27.04 project within the Regional Center PCD. The Parcel 27.04 project is located on the northeast corner of PGA Boulevard and Kew Gardens Avenue.

Consent Agenda includes:

- Purchase Award – Rental of Miscellaneous Industrial and Commercial Equipment – Openly competed – This Agreement establishes a pool of vendors from which the City may rent equipment for hurricane and emergency preparat ions and secure reim bursement from FEMA. The City may also use the Agreement to rent equipment in support of its normal operations. During the term of the Agreement, new vendors may be added to the vendor pool, provided they meet the

minimum requirements established in the original solicitation. Five year contract with option to renew for five years – $500K - Purchase Award – Traffic Signals for Northlake-Ancient Tree-Bay Hill Intersection – Piggyback/Access contract – upon completion – $322K

- Purchase Award – Bunker Gear for Fire Rescue Department (2020) – Piggyback/Access contract – upon delivery – $80K

- Purchase Award – Replacement Irrigation Pump Station for Sandhill Crane Golf Club – Bid waiver – In previous years, the City advertised two solicitations for the replacement of irrigation pump stations at several parks and received only one response in each instance. The manufacturer has never responded and when contacted has always offered the City a lower price than the sole responding contractor. The City will purchase the replacement irrigation pump station

from the manufacturer and then obtain competitive quotations for the installation of the equipment – uponn delivery – $101K - Purchase Award – Paving of Municipal Complex Roadways and Parking Areas – Piggyback/Access contract – $85K

- Purchase Award – Fencing for Gardens Park Baseball Expansion – Piggyback/Access contract – $118K

- Change Order – Paving of Public Services Operations Center and Adjoining Areas – Revised contract value (up $130K) – $957K

- Resolution 3, 2020 – Approval of an agreement with the Children’s Healthcare Charity, Inc. for the 2020 Honda Classic PGA Golf Tournament to provide a public safety grant for Police and Fire Services and related staff services, and the use of specific portions of Mirasol and PGA National Parks for various parking facilities and general operations – $144K

Please check the agenda for any changes or additions prior to the meeting.

Finance Director Argues 8.8% Tax Increase Needed

The primary reason for the second City Council meeting in September is always because of the Final Hearing and Approval of the next year’s millage (tax rate) and budget. Finance Director Allan Owens gave a presentation seemingly designed to rebut Mayor Marciano’s position that the millage could be reduced from 5.55 to 5.50. Positions taken by the Council remained unchanged from First Reading – with Council Members Woods, Marino, Litt and Lane making various statements in support of keeping millage flat, and Mayor Marciano restating that “government should do as much as it can with as little as it can”. Always lost in the discussion, especially when pointing out the minimal dollar amount of the increases (whether City, School Board, County Commission) is that is it is the tax-payer’s money – not the government’s. Pennies here and pennies there do add up. Claims that holding a tax rate flat while valuations go up is not raising taxes when the actual tax dollars taken in are going up 8.8% is disingenuous. Read our analysis of the 2019/2020 Budget – 8.8% Tax Increase in 2020 Proposed Budget.

Not surprising, then, that Resolution 61, 2010 – Adopting A Tax Levy and Millage Rate passed 4:1 with the mayor voting No. The associated 2019/2020 Budget (Ordinance 20, 2019) passed 5:0 since there was no point in Mayor Marciano voting no on the actual budget once the millage had passed.

The meeting began with a crowded hall – filled with members and supporters of the PickleBall Athletic Club. After Mayor Marciano pointed out that the issues three members raised were not policy, and thus not related to the Council, City Manager Ferris asked the group to meet with Charlotte Presensky (Leisure Services Administrator) and members of her staff in the lobby.

Also making public comment was PBG resident Laurie French, PBGYAA Secy and Executive Board member thanking the City for the Soccer Fields in Gardens District Park.

The City Manager Report included:

- Candice Temple, Media Relations Manager, described the Bahamian Hurricane Dorian Relief Effort joint partnership with Chris Fellowship – see here for more information and how to help.

- City Manager Ferris gave a heart-felt, touching tribute to recently deceased long-time employee and Navy veteran Robin (”Smitty) Smith.

Ordinance 19, 2019 – adopting the City’s Mobility Fee Schedule drew public comment from a representative from Palm Beach County Planning. Khurshid Mohyuddin, Principal Planner, Transportation Planning. He asked that the City wait until the County held a county wide workshop in 2020. It was pointed out that the City’s Mobility Plan had already been approved at the last City Council meeting and that this ordinance was only codifying the fees.

Resolution 68, 2019 included details of the Model Home Row and Enhanced Entry Features for Avenir Pod 4. This subdivision will have separate Model Home Row designed to minimize any impact to construction areas. The homes will range in price from approximately $800K-$1.2 million. The resolution passed 5:0.

There was no City Attorney report. The next City Council Meeting will be held on October 3 at 7pm.

Next City Council Mtg on Thursday, Sept 19

The next City Council Meeting will be on Thursday Sept 19 at 7pm. This meeting will include the Final Hearing and Adoption of the Fiscal Year 2019/2020 Budget as well as other items.

Consent Agenda includes:

- Purchase Award for Systems Furniture for the renovated/expanded areas of the City Complex. Piggyback/Access contract for $372K

Ordinances and Resolutions include:

- Resolution 61, 2019 – Adopting a tax levy and millage rate for the City of Palm Beach Gardens for the Fiscal Year commencing October 1, 2019, and ending September 30, 2020 and associated Ordinance 20, 2019 – Public Hearing for Second and Final Reading Adopting the Fiscal Year 201 9/2020 Budget.

- Ordinance 19, 2019 – Second reading and adoption of a City-initiated request to amend Chapter 78 of the City’s Code of Ordinances to incorporate a new Impact Fee Schedule for the City of Palm Beach Gardens Mobility Fee to be applied and assessed in the Mobility Fee Assessment Area in lieu of Transportation (Road) Impact Fees, pursuant to the adoption of the City’s Mobility Plan

- Resolution 67, 2019 – while publicly noticed, this resolution Avenir – Site Plan 1 Pods 1 and 3 model homes, model home row, and upgraded entry features has been requested to be postponed by the applicant. It will be opened for public comment and after the public hearing is closed, it will be postponed.

- Resolution 68, 2019 – Avenir Site Plan #1 – Pod 4 Site Plan Amendment Approval – to approve architectural models, design and diversity criteria for custom built homes, a model home row, and an enhanced entry feature for residential Pod 4 that is in Site Plan #1

Check the agenda to see if any additional items have been added before the meeting here.

Mayor Marciano – Gardens Should Lead by Reducing the Millage

First reading of the annual Budget typically results in discussion by the Council, and this year was no exception. See 8.8% Tax Increase in 2020 Proposed Budget and the Palm Beach Post article for more details about the budget specifics. After the Powerpoint presentation made by Finance Director Allan Owens, Mayor Marciano kicked off his analysis of the proposed budget. Unlike the remainder of the Council, the Mayor was previously on the Budget Review Committee (see report here) for several years prior to being elected to the Council and has an in-depth knowledge of the City’s finances not apparent in the others on the Council. He once again echoed former Mayor Bert Premuroso (also knowledgeable on budget matters).

Marciano proposed that the millage be cut to 5.50 rather than the staff recommended 5.55. The Mayor described the uses of the Budget Stabilization Reserve Fund which have strayed from its original intent when created, for critical items, to cover useful but not critical budget items as they come up during the year. Staff always projects depletion of the Fund, but somehow it always ends up having many times the original $500K balance intended when formed. Marciano pointed out that while the City may be run efficiently as is a business, it is NOT a business and it’s goal is to provide critical needs for the taxpayer. He also said that the City has lowered millage in the past, and if it can’t do so in good times – when will it? He stated that Palm Beach Gardens should lead by example, as it prides itself on doing in other areas, and lower millage. Lowering the rate from 5.55 to 5.50 is of minimal impact to the City but is giving money back to the taxpayer.

Others on the Council did not discuss the points specifically made by Marciano but echoed fears of potential disasters (which is what the $23 million Reserve Fund is for), and in some cases displayed ignorance of how a taxpayers’ total tax bill is calculated. The vote was 4:1 and the Mayor remained open to further discussion. (PBG Watch is in total support of lowering the millage to 5.50)

In other business:

- State Representative Rick Roth gave a Legislative Update, postponed from an earlier Council meeting..

- All Ordinances and Resolutions, other than the Fiscal Year 2019/2020 Budget, passed 5:0 with minimal discussion by Council.

- Public Comment was made by Tom Cairnes of PGA Corridor about upcoming meetings, and by Steen Ericksson, representing the Fire Chiefs Association of Palm Beach County inviting people to the 9/11 Remembrance Ceremony at Christ Fellowship Church in Boynton Beach at 7pm.

- Additionally – during discussion of the Purchase Award for Gasoline and Diesel Fuel, pulled from Consent by Council Member Lane – it became apparent that the Burns Rd Public Works Property was removed from the market and the pending sale last mentioned in PBGWatch after the May City Council meeting fell through. For more details – see Resolution 55, 2019.

The next City Council Meeting will be held on Thursday September 19, 2019 at 7pm – and includes the Final Hearing and vote on the Fiscal Year 2019/2020 Budget and millage rate.

8.8% Tax Increase in 2020 Proposed Budget

The proposed 2020 PBG Budget raises $5.5M in new taxes, up whopping 8.8% over last year. See the Proposed Budget here.

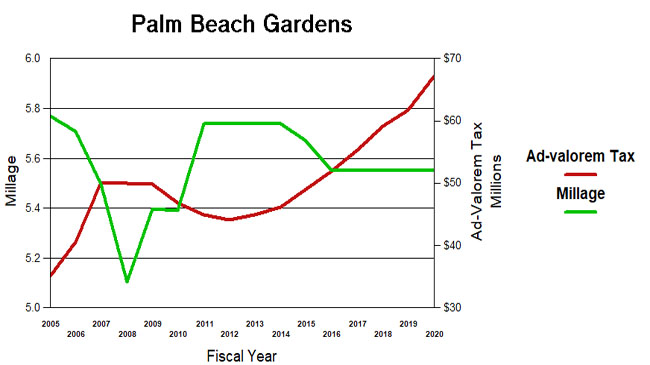

With the millage flat at 5.55 since reduced to that level in 2016, this is the fifth year that increases in property valuations and new construction have flowed money into the city coffers without having to say they “raised taxes”. In 2015, ad-valorem revenue was $49M. This year’s $67M is a 38% increase in tax haul over 5 years.

If you add in the effect of the 10 year 1% sales tax surcharge which gives the city about another $3M per year, the increase over 2015 is actually 67%.

You may recall that prior to the passage of the sales tax surcharge in 2016, PBG staff had said they didn’t need any additional sources of funds, and if it passed, would return some to the taxpayers in a millage reduction. That too changed of course when the full 10 year revenue stream was captured in a bond and allocated to projects starting immediately, including $11M for a new park.

Assuming the flat millage budget is passed, the 8.8% tax increase compares to an increase in population of about 2.3% and about 2% inflation, so the increase is about twice what economic conditions would expect. A token decrease in millage to 5.50 suggested by Mayor Marciano (representing about $600K), would still produce taxes far above what population and inflation would suggest.

TABOR

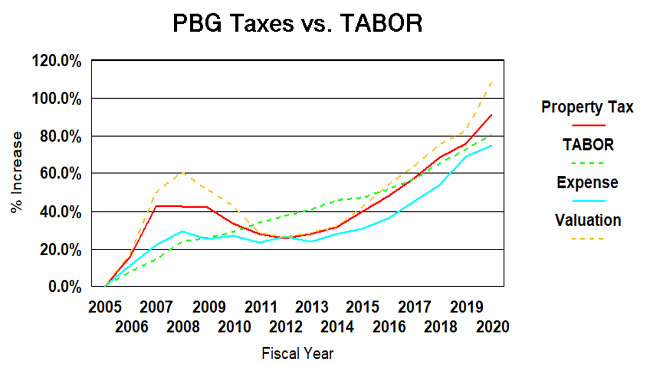

In 1992, the state of Colorado amended their constitution to restrict the growth of taxation. Under the “Taxpayer Bill of Rights” (TABOR), state and local governments could not raise tax rates without voter approval and could not spend revenues collected under existing tax rates without voter approval if revenues grow faster than the rate of inflation and population growth. The results of this Colorado experiment are mixed, and TABOR has its pros and cons. (For background on TABOR, see: Taxpayer Bill of Rights ) Population growth and inflation though, would seem to be a way of assessing the appropriateness of the growth of a city budget, at least as an initial benchmark.

Since 2005, the population of Palm Beach Gardens will have grown by about 34% (BEBR estimate – see below) to its 2020 level of 56K. Inflation, measured by the consumer price index, will be about 35%. Taken together, TABOR would suggest a growth in city spending and taxation of about 80%. (see graph below).

Over the same period (2005-2020), ad-valorem taxes grew 91% and total expenditures (budget less debt payment, capital and transfers) grew 75%. Spending closely follows the TABOR line, and ad-valorem taxes is not widely divergent (although exceeding TABOR since 2014) suggesting spending and taxation appropriate to a growing city.

It should be noted that ad-valorem taxes fund only a part of city expenditures, the rest made up from impact fees, fees for services, other taxes, intergovernmental grants, etc. and have varied from 66% of the total in 2005 to about 73% now. That is why taxes and expenses do not track each other on the chart.

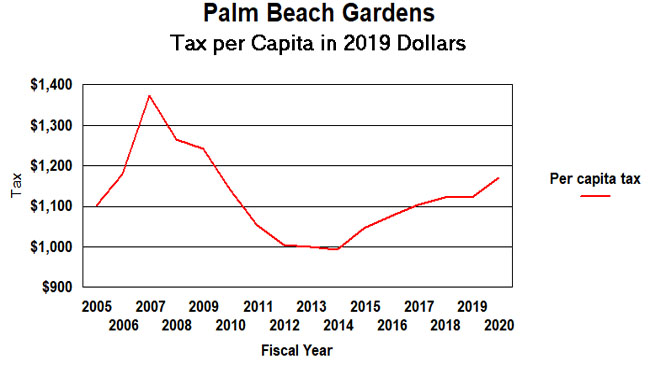

Another useful measurement is taxes per capita – Ad valorem taxes divided by population and then inflation adjusted. By this measure, in 2005 we paid $1,101 per person to our city and in 2020 it will be $1,122 (2019 dollars). Although not too far above the 2005 level, tax per capita was as low as $994 in 2014 after a millage reduction. It should be noted that as property owners, we pay taxes to other entities besides the city – county, schools, health care district, etc. In 2019 the Palm Beach Gardens portion of the amount on our TRIM statement is about 27% of the total.

The chart below shows a steady growth in per-capita taxation, yet there is reason to believe the BEBR population estimates have missed some of the city’s growth (see below). If the numbers are adjusted to match the growth in voter registrations since 2016 for example, the curve is much flatter since there are more people to pay the taxes.

So if you trust TABOR, or per-capita as measuring sticks, is this growth in taxation appropriate? You be the judge.

A word about population estimates.

Estimates of the Gardens population vary. The numbers used in the preceding two charts are based on the University of Florida’s Bureau of Business and Economic Research (BEBR) data. By their measure, we have grown 33.6% since 2005, and 2.3% in the last year. The US Census has a different set of numbers and they claim 37.3% and 1.4% respectively. BEBR says we will have 56,302 residents next April, the Census says 57,860.

I have reason to believe that both of these estimates are too low. In 2017, the city annexed Osprey Isles and Carleton Oaks (about 650 residents) and in 2018 Bay Hill and Rustic Lakes (aobut 1340 residents). It is not clear that either BEBR or the census adjusts for annexations between census decinnials. Also, certain areas of the city are growing rapidly, such as Alton.

If you look at voter registration data, assuming that the population as a whole was growing at the same rate as the voter rolls, you see more rapid growth. In 2016 there were 37,878 registered voters in the Gardens, 74% of the population based on BEBR. By 2019, the voter rolls had grown to 44,847, up 18%. A similar ratio applied to population would yield 61,013 residents in 2019, and by extension, 65,028 in 2020. Precinct 1190 (which includes Alton) now has about 4300 voters. In 2014 it had about 2500.

Next City Council Mtg on Thursday, September 5 at 7pm

We hope that this post finds you and your loved ones safe from Hurricane Dorian. Assuming that all is well on Thursday and nothing changes, the next City Council Meeting will be on Thursday, September 5th at 7pm in City Hall.

Presentations include:

- FL State Representative Rick Roth – with a Legislative Update

Consent Agenda includes:

- Resolution 57, 2019 – Terminating the City’s lnterlocal Agreement with Palm Beach County for Traffic Concurrency Certification Review – The City of Palm Beach Gardens has prepared a Mobility Plan and Fee Report as provided by Section 163.3180 (5) (i), Florida Statutes. Accordingly, the City’s lnterlocal Agreement with Palm Beach County setting forth the procedure for review of Traffic Concurrency Applications is no longer necessary and is recommended to be terminated Second Reading and Adoption of the Mobility Plan is Ordinance 16, 2019 on the Regular Agenda.

- Purchase award – Tires and Related Services – Piggyback/access contract for 3 years with no option to renew – $330K

- Purchase award – Gasoline and Diesel Fuel – Piggyback/access contract for 3 years with option to renew ‘Per State of FL Contract’ – $2 million

Public Hearings and Resolutions – New Business/First Readings includes:

- Ordinance 18, 2019 – First reading – A City-initiated request to amend Division 8. Landscaping of the City’s Land Development Regulations to add a definition of Residential Property to conform to recently approved legislation. Of interest to owners of residential property in the Gardens: On June 26, 2019, the Governor signed into law the Committee Substitute of House Bill 1159, amending Section 163.045, Florida Statutes, relating to tree trimming, pruning, and removal on residential property. Specifically, the bill prohibits a local government from requiring a notice, application, approval, permit, fee, or mitigation for pruning, trimming, or removal of a tree on residential property if the property owner obtains documentation from an arborist certified by the International Society of Arboriculture or a Florida-licensed landscape architect that the tree presents a danger to persons or property. The bill further prohibits a local government from requiring a tree to be replanted if the tree was pruned, trimmed, or removed for this reason.

- Ordinance 19, 2019 – First reading – A City-initiated request to amend Chapter 78 of the City’s Code of Ordinances to incorporate a new Impact Fee Schedule for the City of Palm Beach Gardens Mobility Fee to be applied and assessed in the Mobility Fee Assessment Area in lieu of Transportation (Road) Impact Fees, pursuant to the adoption of the City’s Mobility Plan. (Ordinance 16, 2019 – to be approved earlier in the agenda)

- Ordinance 20, 2019 – Public Hearing for First Reading of Ordinance 20, 2019 Adopting the Fiscal Year 201 9/2020 Budget.

BACKGROUND: This is the first of two required public hearings to set the millage and adopt the budget for Fiscal Year 2019/2020. On July 11 , 2019, Council approved Resolution 39, 2019, setting the maximum tentative operating millage rate for FY 2019/2020 at 5.55 mills. The proposed operating millage of 5.55 is 4.19% above the roll-back rate of 5.3268. The total operating millage rate proposed for Fiscal Year 2019/2020 is 5.55 mills, which is less than the current year rate of 5.6003 mills.

Total sources for all funds is $175,554,209, consisting of total estimated balances carried forward of $47,981,051 and projected total revenues of $127,573,158. Total sources of funds are balanced with projected total expenditures of $128,858,551 and ending reserves of $46,695,658, for a total use of funds of $175,554,209.

The second and final public hearing on the budget is scheduled for September 19, 2019. For more details see the 2019/2020 Proposed Budget page.

Check the agenda to see if any additional items have been added before the meeting here.

Virgin Trains impacts, Mobility Plan, 2019/2020 budget max millage and more

The agenda for the July 11th City Council took the max allotted time of 4.5 hours. Council Member Marino was not in attendance and all Ordinances and Resolutions passed 4:0. Since most attendees probably did not last until the end of the meeting here are a few highlights.

- City Manager Ferris was offered a new contract (as discussed at the June 2019 City Council Mtg); Council Member Woods proposed that on top of the 3% cost of living increases that the City Manager (and staff and thus the Council) have been getting over the last several years, that Mr. Ferris be given a one-time 6% increase.

Mr. Ferris’ current salary at $239K is only less than the City Administrator of Palm Beach County at $270K, Boca Raton’s city manager of $240K and West Palm Beach at $240K. The Council’s rationale was that the top city in Florida to live in should have a city manager earning a top salary. There was no analysis of number of employees, city population or anything else.

- The maximum millage for the 2019/2020 Fiscal Year Budget was set at 5.55 – it can be lowered but not raised. The operational budget has been at 5.55 for several years as well – and given continued rising valuations, this will most likely be a tax increase for most property owners. The proposed budget can be found here. The first public hearing on the Fiscal Year 2019/2020 Budget will be held on September 5, 2019, at 7:00 pm in the City of Palm Beach Gardens Council Chambers.

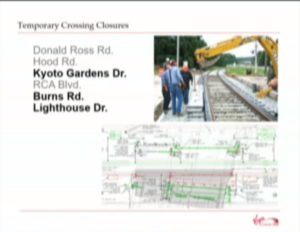

- Representatives of Virgin Trains

gave an update on service to Orlando, expected by mid-2022. Their plans are still to have 16 round-trips per day to Orlando. See the Palm Beach Post article here for a summary of the update. Of note and not in the article – each crossing in the City will have to be closed for up to 10 days each, with the Kyoto Gardens intersection having to be closed twice for up to 10 days each. Plans are to not have adjacent crossings closed at the same time and to have well marked detours.

gave an update on service to Orlando, expected by mid-2022. Their plans are still to have 16 round-trips per day to Orlando. See the Palm Beach Post article here for a summary of the update. Of note and not in the article – each crossing in the City will have to be closed for up to 10 days each, with the Kyoto Gardens intersection having to be closed twice for up to 10 days each. Plans are to not have adjacent crossings closed at the same time and to have well marked detours.

- The Palm Beach Gardens Mobility plan and updated fees had considerable discussion.

There is only so much that city roads can be widened, so alternative modes of transportation will need to be considered. Most of the discussion however was due to a letter sent from Palm Beach County Administrator Verdenia Baker opposing modifications to the current transportation concurrency/road impact fees with a transition to Gardens’ mobility fees. Natalie Crowley, Director of Planning and Zoning outlined what PBG considered as wrong assumptions in the County’s letter. Patrick Rutter, Assistant County Administrator outlined the County’s issues; Nick Uhren, Director of Palm Beach County Transportation Planning Agency and Dr. Kim Delaney, Director of Strategic Development and Policy for the Treasure Coast Regional Planning Council, both spoke in full support of the City’s plan and fee approach.

There is only so much that city roads can be widened, so alternative modes of transportation will need to be considered. Most of the discussion however was due to a letter sent from Palm Beach County Administrator Verdenia Baker opposing modifications to the current transportation concurrency/road impact fees with a transition to Gardens’ mobility fees. Natalie Crowley, Director of Planning and Zoning outlined what PBG considered as wrong assumptions in the County’s letter. Patrick Rutter, Assistant County Administrator outlined the County’s issues; Nick Uhren, Director of Palm Beach County Transportation Planning Agency and Dr. Kim Delaney, Director of Strategic Development and Policy for the Treasure Coast Regional Planning Council, both spoke in full support of the City’s plan and fee approach. - FPL sought approval for changes to its plans for the office building on Kyoto Gardens Drive.

See the article for more details. Several members of the business community spoke in support and a resident inquired about the heliport stop.

See the article for more details. Several members of the business community spoke in support and a resident inquired about the heliport stop.

Next City Council Meeting on Thursday July 11 at 7pm

The next City Council meeting will be on Thursday, July 11, at 7pm.

The meeting has quite an extensive agenda covering a lot of topics. For those interested in Brightline, there will be a presentation on Future Plans for Train Service to Orlando. Additionally, there will be a 2019 Legislative Update by State Senator Bobby Powell.

Presentations and Announcements also includes recognition of Wendy Tatum as Manager of the Year by the United States Professional Tennis Association.

Consent Agenda includes:

- Purchase Award: Financial Advisory Services – exercising option to renew existing contract for 5 years – $120K over 5 years

- Purchase Award: Group Health Insurance Plan (Self-Funded) – Stop Loss Insurance Coverage – exercising option to renew for remaining 1 year of contract – $562K.

- Purchase Award: Independent Auditing Services – openly competed – 5 year contract total $447K

- Purchase Award: Switches and Related Equipment for New Telecommunications System – Piggyback/Access Contract for $118K

Public Hearings and Resolutions – Only first readings and new business listed below:

- Ordinance 12, 2019 – An amendment to the City of Palm Beach Gardens Firefighters’ Retirement Trust Fund.

- Ordinances 14/15, 2019 – Bay Hill Estates – First reading – city initiated ordinances to update Large-Scale Comprehensive Map and Zoning for the recently annexed area

- Ordinance 16, 2019 – Mobility Plan and Mobility Fee – First reading – city initiated – request for approval and adoption of the Mobility Plan and Fee, which also has an impact on traffic concurrency agreements

- Resolution 44, 2019 – a request by PGA Marina to install three sets of automated crossing arms within the marina site

- Resolutions 45/46, 2019 – A request by FPL for an amendment to the PGA Office Center to combine Parcel A and Parcel B, realign the northern 400 feet of RCA Center Drive for a new intersection location at Kyoto Gardens Drive, and to add 1.3 acres of lake area to Parcel A. The request also includes site plan approval for a 270,000-square-foot office building, three-story parking garage, and helistop within 37.74 acres of affected area on the south side of Kyoto Gardens Drive.

- Resolution 52, 2019 – A request from Nuvo Riverside, LLC to enter into a Miracle League Field Funding Agreement with the City of Palm Beach Gardens. This agreement will result in the Applicant providing a one-time payment to the City toward the funding of the Miracle League fields.

- Resolution 29, 2019 – Gold Star Families Memorial Monument at Veterans Plaza – A request to install a Gold Star Families Memorial Monument at the City of Palm Beach Gardens’ Veterans Plaza

- Resolution 39, 2019 – Adopting a proposed maximum millage rate for the City of Palm Beach Gardens for FY 2019/2020, and setting the date, time, and place of the first public budget hearing.

Items for Council Action/Discussion includes discussion of a City Manager Contract – requested by Council at last month’s evaluation of the City Manager.

Check the agenda to see if any additional items have been added before the meeting here.

Both City Hall and Tennis Center 1-Cent Sales Tax Projects Revised

Tennis Center Plans

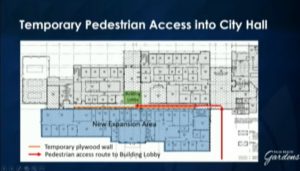

Construction bids for the City Hall Renovations (Resolution 7, 2019) and Tennis Center Renovations (Resolution 8, 2019), both funded by the 1% sales tax, exceeded the budget for the projects. So the City downsized the ambitious plans somewhat to fit both projects within their original budgets and worked with the lowest bidders to adjust plans and materials. These resolutions provided for the City Manager to negotiate and execute with the selected bidders for both projects. The City Hall Renovations will impact both traffic patterns and entry/exit points to the Municipal Complex.

Pedestrian Access

Ordinance 1, 2019 – 2nd Reading and Adoption Budget Amendment – Finance Administrator Allen Owens informed the council that the sale of the Public Works Property did not go through, so the amendment was changed to delete $1.38 million from the budget stabilization reserve fund accordingly, now at $2.4 million.

Both Council Members Lane and Litt each pulled two items from the from the Consent Agenda for further discussion and presentations, but those items and Consent were all passed 5:0. One of Mrs. Litt’s items was a Proclamation by the Mayor on behalf of 211 Awareness Week, which was read aloud. More information on the 211 Helpline can be found on their website.

All Ordinances and Resolutions passed 5:0.

During Items for Council Action/Discussion, Council Member Marciano brought up the topic of Workforce/Essential Services Housing and how more work is needed on the subject. (In January’s meeting, Council Member Lane had said that a workshop will be held on the subject some time in the near future. ) Mayor Marino raised the subject of speed of the traffic on the western portions of Northlake Boulevard.

City Attorney Max Lohman gave a brief status on both lawsuits by resident Sid Dinerstein. When asked how much the two cases have cost the City so far, his response was in excess of $70K.

- 4th District Court of Appeals ruled on behalf of the City on Question 3 (3-yr sit out before running again) from the March, 2018 election – but is being asked for reconsideration

- 2/11 – Hearing for Summary Judgement on Question 2 (the Charter repeal/replace) from August, 2018 election, with the City taking the position that the case is without merit; at the hearing both sides were given additional time to provide the judge with additional information.

Other Upcoming Events:

- February 24 – March 3 – The Honda Classic

- February 28 – Beeline Highway FDOT Public Hearing at Burns Road Community Center (see http://www2.dot.state.fl.us/publicsyndication/PublicMeetings.aspx/publicmeetings)

- March 12 – City Elections – Group 4 (Candidates: Carl Woods and Howard Rosenkranz). See the City Elections site for more details.